The Ultimate Guide to the Best Corporate Virtual Card for Your Business

- Corporate Cards

- Spend Management

- 26-Feb-25

What Are Virtual Cards?

What is a virtual card? A virtual card is a digital version of a traditional credit or debit card, designed specifically for online transactions. It allows users to make secure and convenient payments without exposing sensitive bank details or the primary card number. Virtual cards function similarly to their physical counterparts but offer added layers of security and flexibility, making them especially popular for business-related expenses.

These cards can be issued instantly, enabling users to access funds and make purchases without waiting for a physical card to arrive. They are widely used for online purchases, subscription management, travel expenses, and vendor payments, and are a valuable tool for businesses seeking greater control over their financial operations.

How Do Virtual Cards Work?

A virtual credit card operates like a regular card, but it exists solely in digital form. Each virtual card is tied to a primary card or bank account and is typically equipped with a unique card number, expiration date, and CVV code. Businesses can use virtual credit cards for various purposes, from making one-time payments to handling recurring transactions, without revealing the original card details.

Incorporating spend controls such as transaction limits, merchant category restrictions, and expiration dates, virtual credit cards offer businesses unparalleled flexibility in managing their expenses. Once the transaction is completed, the card information becomes obsolete, minimizing the risk of fraud.

Benefits of Virtual Cards

Virtual cards offer a wide range of benefits, particularly in a corporate environment where security, efficiency, and cost control are critical.

Unlike traditional credit cards, virtual cards offer enhanced security and flexibility, making them ideal for corporate use.

1. Risk Mitigation

Virtual credit cards are a powerful tool for reducing the risk of fraud. Since they are typically issued for a single transaction or a limited period, they minimize the exposure of sensitive financial information. Businesses can create unique virtual cards for each purchase or vendor, reducing the risk of unauthorized transactions or data breaches.

2. Budget Control

One of the most significant advantages of virtual cards is the ability to set precise spending controls. Businesses can limit the total spend, transaction amount, and merchant category for each card, ensuring that spending stays within budget. This feature is particularly useful for controlling employee expenditures and managing vendor payments.

3. Instant Issuance

Unlike traditional cards, which may take days or weeks to arrive, virtual cards can be issued instantly. This makes them ideal for businesses that need to make immediate payments or quickly equip employees with the necessary funds for travel, vendor purchases, or subscription management.

4. Enhanced Security

Virtual cards add a layer of security to online transactions. With unique numbers generated for each transaction, businesses can ensure that their primary account or credit card information is never exposed. This added protection can significantly reduce the likelihood of fraud.

5. Efficient Spend Management

Virtual cards allow businesses to consolidate their spending across multiple departments or projects. Real-time reporting and transaction data provide immediate insights into spending patterns, making it easier to track expenses and improve budgeting accuracy.

6. Seamless Integration

Most virtual card providers offer integrations with popular accounting and expense management software. This simplifies the reconciliation process and enhances the overall efficiency of corporate financial management.

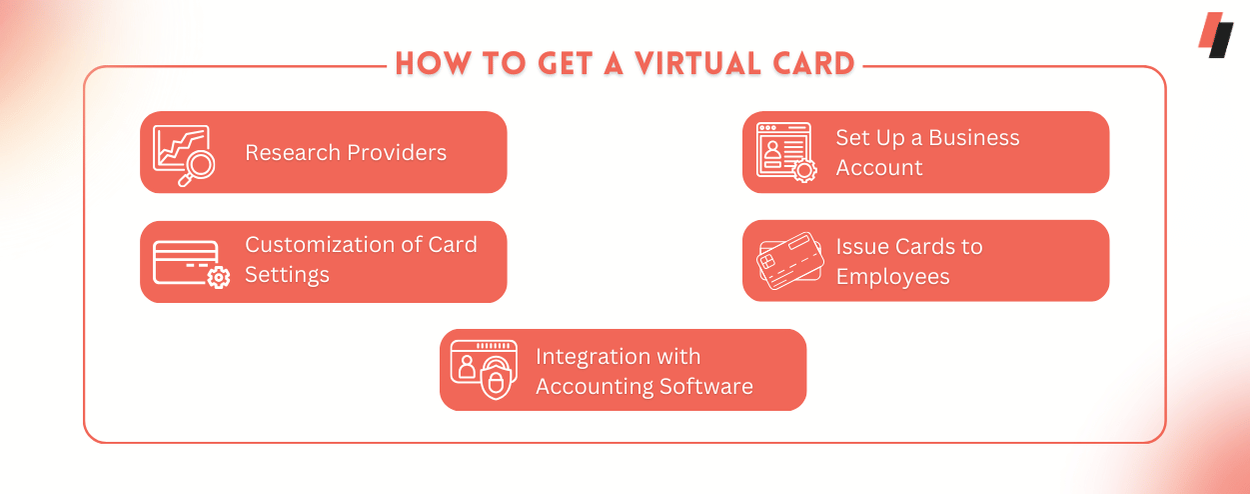

How to Get a Virtual Card

Obtaining a virtual corporate card is a straightforward process, but it requires careful consideration of the business’s needs and the available providers.

1. Research Providers

Before choosing a provider, research various virtual card issuers to understand what they offer. Consider factors such as security features, customization options, and integration with existing accounting software. Popular providers include banks, fintech companies, and dedicated payment platforms.

2. Set Up a Business Account

To acquire a virtual corporate card, you'll need to establish a business account with the selected provider. During this process, the provider will typically verify your business's legitimacy by requesting relevant documents.

3. Customization of Card Settings

Once your account is approved, you can customize the virtual card settings. This includes establishing spending limits, defining the authorized user list, and setting expiration dates.

4. Issue Cards to Employees

After customization, you can issue virtual cards to employees or departments based on business needs. Virtual cards can be distributed immediately, and specific spending parameters can be set for each cardholder.

5. Integration with Accounting Software

For seamless expense tracking and reconciliation, integrate the virtual card with your accounting or spend management software. This ensures all transactions are automatically logged and accounted for.

Features of a Virtual Corporate Card

What is a virtual corporate card? Virtual corporate cards come with a host of features designed to make corporate spending more efficient and secure.

1. Unlimited Cards

Companies can issue multiple virtual cards to different departments or employees. This makes it easier to track spending across various functions, and each card can be tailored to the specific needs of its user.

2. Spend Control

Businesses can set specific limits for transaction amounts, total spend, and merchant categories for each virtual card. This provides precise control over where and how company funds are spent.

3. Real-Time Reporting

Virtual cards often come with real-time transaction tracking and reporting features, allowing businesses to monitor spending as it happens. This enables timely decision-making and helps prevent overspending.

4. Simple Reconciliation

Thanks to integration with accounting systems, virtual cards streamline the reconciliation process. Detailed reports can be generated automatically, reducing the administrative burden of manual entry and ensuring greater accuracy.

5. Flexible Setup

Virtual cards can be easily configured based on business needs. Whether it’s a single-use card for a one-time vendor payment or a recurring card for ongoing expenses, virtual cards offer unmatched flexibility.

Virtual Corporate Card Use Cases

Virtual corporate cards are used across industries for various purposes. Some common use cases include:

1. Online Purchases

Virtual cards are ideal for online transactions, particularly when businesses need to purchase goods or services without exposing their primary financial information.

2. Subscription Management

Many companies use virtual cards to manage recurring subscriptions for software, tools, and services. Virtual cards can be set with specific expiration dates or transaction limits to prevent overspending or auto-renewals on unwanted services.

3. Travel Expenses

Businesses can issue virtual cards to employees for travel-related expenses such as flights, hotels, and meals. Spending limits can be enforced to ensure that employees do not exceed their travel budgets.

4. Vendor Payments

Companies often use virtual cards to pay vendors, as they provide greater control over the amount and frequency of payments. Virtual cards can be generated for one-time transactions or set up for recurring vendor payments.

Choosing the Right Virtual Card Provider

Selecting the right virtual card provider is crucial for maximizing the benefits of this payment solution. Here are some factors to consider when evaluating potential providers:

1. Security

Look for a provider that prioritizes security. Features like tokenization, encryption, and two-factor authentication help protect your business from fraud.

2. Flexibility

Ensure that the provider offers customizable options, including spending controls, expiration dates, and transaction limits.

3. Integration

Choose a provider that integrates seamlessly with your existing accounting or expense management systems. This will simplify reconciliation and make it easier to track spending.

4. Fees and Charges

Be mindful of any associated fees, such as transaction charges or monthly maintenance fees. Some providers may also offer rewards programs, which can provide additional benefits for your business.

5. Customer Support

Reliable customer support is essential. Look for providers with a strong reputation for assisting businesses and resolving issues quickly.

Exploring Virtual Cards with Spend Management for Corporate Spends

For businesses seeking centralized control over expenses, virtual cards offer a powerful spend management solution.

1. Centralized Spend Management

Virtual cards allow businesses to manage spending across multiple departments from a single platform. This centralization ensures that financial managers have full visibility into corporate spending, leading to better decision-making and budgeting.

2. Real-Time Visibility

Real-time reporting features provide up-to-date insights into spending patterns, helping businesses identify potential issues or overspending before it becomes problematic.

3. Streamlined Spend Management

By using virtual cards, businesses can consolidate payments, streamline the reconciliation process, and reduce administrative overhead. This efficiency is especially valuable for large enterprises with multiple departments or locations.

Explore Virtual Cards with UPI

Unified Payments Interface (UPI) integration adds another layer of convenience to virtual cards. By linking virtual cards with UPI, businesses can enable faster and more secure payments, particularly for vendor transactions or employee reimbursements. UPI offers a seamless, real-time payment mechanism that further enhances the efficiency of virtual cards in corporate spend management.

Why Choose UPI for Better Corporate Spend Management?

UPI's real-time payment capabilities complement virtual cards by providing instant fund transfers and lower transaction costs. For businesses looking to enhance their spend management solutions, integrating UPI with virtual cards can provide a more secure and efficient way to manage corporate expenditures. It also eliminates the need for intermediaries, reducing the risk of fraud and errors in payments.

1. Instant Transactions:

Real-time Settlement: UPI transactions are processed instantly, eliminating the need for lengthy settlement periods and reducing the risk of delayed payments.

Improved Cash Flow: Prompt payments ensure a smoother cash flow for businesses, enabling better financial management and planning.

2. 24x7 Accessibility:

Round-the-Clock Payments: UPI allows businesses to accept payments at any time, even outside of banking hours. This flexibility is particularly beneficial for online businesses and those operating in remote locations.

Enhanced Customer Convenience: Customers can make payments at their convenience, leading to increased customer satisfaction and loyalty.

3. Low Transaction Costs:

Reduced Fees: UPI transactions typically involve nominal fees, making them a cost-effective option for businesses of all sizes.

Improved Profitability: Lower transaction costs contribute to increased profitability and competitiveness.

4. Enhanced Security:

Multiple Layers of Protection: UPI employs advanced security measures, including biometric authentication and tokenization, to safeguard transaction data.

Reduced Risk of Fraud: The secure nature of UPI minimizes the risk of fraudulent activities, protecting businesses and customers alike.

5. Seamless Integration:

API Integration: UPI can be easily integrated into various business applications and platforms, streamlining payment processes.

Improved Efficiency: Automation of payment processes reduces manual errors and improves overall operational efficiency.

6. Wider Reach:

National Coverage: UPI is widely accepted across India, enabling businesses to reach a broader customer base.

Increased Market Penetration: Businesses can tap into new markets and expand their customer base with ease.

7. Customer Convenience:

Easy-to-Use Interface: UPI offers a simple and intuitive interface, making it easy for customers to use.

Reduced Friction in the Payment Process: Customers can complete payments quickly and efficiently, leading to a positive customer experience.

By selecting the right provider and integrating virtual cards with spend management tools like UPI, businesses can achieve greater security, efficiency, and control over their finances