UPI Payment: Unified Payments Interface & The UPI Payment Revolution

- UPI

- 30-Nov-23

What is UPI (Unified Payments Interface)?

Unified Payments Interface (UPI) is a real-time payment system that enables individuals to transfer money between bank accounts using a mobile device with internet connectivity. UPI was launched by the National Payments Corporation of India (NPCI) in 2016 and has since become one of the most popular and widely used digital payment methods in India.

__1234.png)

History of Unified Payments Interface

The Unified Payments Interface (UPI) is a revolutionary digital payment system that has transformed the way people make financial transactions in our country, India. It was developed by the National Payments Corporation of India (NPCI) and was officially launched in April 2016. UPI has since become one of the most popular and widely used payment methods, offering a seamless and interoperable platform for various financial institutions and payment service providers.

The UPI history can be traced back to the Reserve Bank of India's (RBI) efforts to modernize the country's payment infrastructure. The idea of creating a unified platform for digital payments emerged as a solution to simplify and streamline the complex and fragmented payment systems. This fragmentation was largely due to the existence of multiple banks and financial institutions each offering their own digital payment solutions.

The UPI project received strong support from the Indian government as part of its broader initiative to promote a digital economy and reduce cash transactions. The system aimed to make digital transactions easier, faster, and more accessible to a wide range of users.

Key milestones in the history of UPI:

Conceptualization (2013-2014):

The groundwork for the UPI journey began with the idea of the creation of a single interface for all payment services. The RBI's vision was to provide a platform that would enable users to link their bank accounts to the mobile app or website and transact seamlessly.

Pilot Launch (2016):

UPI was officially launched in April 2016. Initially, a small number of banks and financial institutions participated in a pilot program to test and refine the system.

Expansion (2016-2017):

UPI quickly gained popularity among banks and payment service providers. Over the next couple of years, more banks and financial institutions joined the UPI network, making it accessible to a broader user base.

Demonetization (2016):

The Indian government's demonetization drive in late 2016, which aimed to reduce the use of physical currency, provided a significant boost to UPI adoption as people looked for digital alternatives for their transactions.

Mass Adoption (2017-2021):

UPI's success continued to grow, and by 2021, it had become the dominant digital payment system. The introduction of various UPI-based apps and features, such as Bharat Interface for Money (BHIM), contributed to its widespread use.

Global Recognition (2019-2020):

UPI gained international recognition for its innovative approach to digital payments. It inspired other countries to develop similar systems, and the UPI framework was seen as a model for global digital payment infrastructure.

Continuous Innovation (Ongoing):

UPI has continued to evolve with the addition of new features, such as recurring payments, overdraft facilities, and integration with various financial services. The system's adaptability and ongoing improvements have contributed to its continued success.

Today, the initiative UPI has revolutionized the way Indians make payments, enabling transactions through mobile phones with just a few taps on a screen. It has not only reduced the country's dependence on cash but has also improved financial inclusion by providing a simple, secure, and cost-effective means of transferring money and making payments. The history of UPI reflects India's commitment to embracing digital technology to enhance financial inclusion and promote economic growth.

About National Payments Corporation of India (NPCI)

The National Payments Corporation of India (NPCI) is a vital entity in the Indian financial ecosystem. Established in 2008, it operates as a non-profit organization under the guidance of the Reserve Bank of India and the Indian Banks' Association. NPCI plays a pivotal role in facilitating digital payments and financial inclusion across the country. It oversees the Unified Payments Interface (UPI), which has revolutionized peer-to-peer and merchant transactions, making them more accessible and efficient. Additionally, NPCI manages various other payment systems like National Electronic Funds Transfer (NEFT), Immediate Payment Service (IMPS), and RuPay, the domestic card network. NPCI's efforts have significantly contributed to the transition of India towards a cashless economy, promoting financial accessibility and innovation.

How to Start Using UPI Payments

To start using UPI (Unified Payments Interface) payments, follow these four simple steps:

Choose a UPI-Enabled Bank:

First, you need to have a bank account with a financial institution that supports UPI. Most major banks offer the UPI services. Ensure your bank is one of them, and if not, consider opening an account with a UPI-enabled bank.

Download the UPI App:

Once you have an account with a UPI-enabled bank, download the official UPI app provided by your bank. Alternatively, you can use popular third-party UPI apps like Google Pay, PhonePe, or Paytm, which support multiple banks and provide a user-friendly interface.

Link Your Bank Account:

After installing the UPI app, open it and follow the instructions to link your bank account. You need to provide the bank account details, and the app will verify your identity using your registered mobile number and the associated SIM card.

Set Up the UPI PIN and Start Transacting:

Once the bank account is linked to the UPI app, you'll be prompted to set up a UPI Personal Identification Number (UPI PIN). This is a secure 4- or 6-digit code that you'll need to enter for every transaction. After setting up your the UPI PIN, you can start making payments and transactions, including sending money to other UPI users, paying bills, recharging your mobile, and more.

Features of UPI & UPI payment

Interoperability

The UPI framework is designed to work across various banks and financial institutions, ensuring that users can send and receive money between different banks seamlessly. This interoperability makes it a universal platform for digital payments.

24/7 Availability

UPI transactions can be initiated at any time, day or night, including weekends and holidays. This round-the-clock availability ensures that users have the flexibility to make payments whenever they need to.

Real-Time Transactions

UPI enables real-time fund transfers. This means that when you send money using UPI, it is typically received by the recipient instantly, making it ideal for quick and urgent payments.

Linking Multiple Bank Accounts

Users can link multiple bank accounts to a single UPI ID, simplifying the process of managing and transacting from various bank accounts using a single platform.

Request Money

UPI allows users to send payment requests to others, making it convenient for bill splitting or seeking payments. Recipients can easily approve or decline these requests.

upi Transaction History & Notifications

UPI apps provide users with a UPI transaction history, allowing them to keep track of their payments & view details of past transactions. Users also receive instant notifications for each transaction, enhancing transparency and security.

Follow these Tips to Use UPI Safely (UPI PIN)

Using UPI is a convenient way to make digital payments, but it's important to use it safely to protect your financial information. Here are six tips to help you use UPI safely:

Download Official UPI Apps:

Only download UPI apps from trusted sources, such as the Google Play Store or Apple App Store. Make sure you're using the official app.

Secure Your UPI PIN:

The UPI PIN is like the key to your bank account. Never share it with anyone, & don't write it down in an easily accessible location. Memorize your UPI PIN or use a secure method, like a password manager, to store it.

Beware of Phishing:

Be cautious of phishing attempts. Scammers may send fake messages, emails, or links designed to look like your bank's official communication. Always verify the source of such messages and never click on suspicious links or share personal information.

Check UPI Transaction Details:

Before confirming a transaction, double-check the details, including the recipient's UPI ID and the amount. Once a UPI transaction is initiated, it's often challenging to reverse, so being vigilant is crucial.

Regularly Monitor Your Account:

Keep a close eye on your bank statements and transaction history through the UPI app. If you notice any unauthorized or suspicious transactions, report them to your bank immediately. They can help you resolve any issues and prevent further unauthorized access.

By following these tips, you can use UPI safely & enjoy the convenience of digital payments without compromising your financial security.

What is UPI Lite?

UPI LITE, a novel payment solution, utilizes the NPCI Common Library (CL) app to handle sub-₹200 transactions. It aligns with existing UPI mobile protocols, ensuring consistency and compliance. UPI LITE offers a user-friendly way to conduct low-value transactions, reducing reliance on Remitter bank core systems while ensuring risk management.

What is UPI ID?

A UPI ID, or Unified Payments Interface Identification, is the unique virtual payment address used in digital payment system. The UPI ID allows individuals to send and receive money securely and conveniently through their smartphones. The UPI ID is typically linked to a bank account, making the UPI ID an enabler easy to conduct transactions. The UPI ID replaces the need for traditional bank account details, offering a simpler way to transfer funds, pay bills, or shop online. Users can create a UPI ID through various banking or payment apps & this UPI ID serves as a personal, confidential key for hassle-free peer-to-peer and merchant transactions, fostering financial inclusion and cashless transactions.

UPI ID is a vital financial tool that simplifies transactions, with a unique UPI ID enabling secure, convenient and instant payments. UPI ID serves as the key identifier for seamless UPI transactions, making UPI ID an essential component of the modern digital banking era . UPI ID simplifies the digital payment process.

A Virtual Payment Address (VPA) is a unique identifier used in Unified Payments Interface (UPI) system for digital transactions in India. Virtual Payment Address serves as an alias for a bank account, allowing users to send and receive money without revealing their actual bank account details. A Virtual Payment Address is user-friendly and typically look like an email address, making digital payments more convenient and secure by reducing the need to share sensitive banking information.

What is UPI PIN? How to Generate a UPI PIN?

A UPI PIN (Unified Payments Interface Personal Identification Number) is a 4 to 6-digit secure numeric code that is used to authenticate & authorize transactions made through the UPI. The UPI PIN is a crucial element of UPI transactions, and the UPI PIN helps ensure the security of the financial activities. UPI PIN serves as a secure access code for authenticating & authorizing transactions on the UPI platform. UPI PINs are designed to ensure the security of digital transactions.

When a user initiates a UPI transaction, they are prompted to enter their UPI PIN. This step confirms that the person initiating the UPI transaction is the legitimate account holder. Without the correct UPI PIN, the UPI transaction cannot be completed.UPI PIN is a vital component of the UPI ecosystem, ensuring the security & integrity of digital payments. Users should be diligent in keeping their UPI PIN confidential and regularly update their UPI PIN to enhance their financial security. To prevent fraud, never share your UPI PIN with anyone or on any platform. A UPI PIN is distinct for each bank account and is created by bank account holder.

What are the best UPI apps for UPI Payment?

Some of the most widely used UPI apps at that time are:

Google Pay: Google Pay was one of the most popular UPI apps, known for its user-friendly interface and integration with other Google services.

PhonePe: PhonePe was another popular UPI app known for its wide range of services, including bill payments, recharges, and in-app shopping.

OmniCard: OmniCard Offers UPI without a bank account for maximum safety. OmniCard is an easy-to-use payment app. You can create OmniCard UPI ID using the VPA @OMNI.

Paytm: Paytm was one of the earliest players in the Indian digital payments space, offering a wide range of services, including mobile recharges, bill payments, & e-commerce.

BHIM (Bharat Interface for Money): BHIM is a government-backed UPI app known for its simplicity and security.

Amazon Pay: Amazon's UPI service allows you to make payments on Amazon & other websites, as well as for bill payments & recharges.

4 Steps to Complete a UPI Transaction

To complete a UPI (Unified Payments Interface) transaction, you typically follow these four steps:

1. Choose a UPI App:

First, ensure that you have a UPI-enabled mobile app installed on your smartphone to initiate the transaction. There are several apps available, such as Google Pay, PhonePe, Paytm, BHIM & many others.

2. Link Your Bank Account:

a. Open the UPI app.

b. Select your preferred language & enter your mobile number (the one linked to your bank account).

c. The app will send an SMS for verification. It should automatically detect the SMS & verify your mobile number.

d. Next, you'll need to set a PIN for UPI transactions. This PIN is known as the UPI PIN & is required for secure transactions. Make sure to create a strong PIN & keep it confidential. e. After setting your UPI PIN, link your bank account by selecting the account from list & providing the necessary details. You may be asked to enter your debit card details for verification.

3. Initiate the Transaction:

a. Open the UPI app.

b. Select the option to send money or make a payment.

c. Enter the recipient's UPI ID or mobile number. UPI IDs typically look like example@bankname (e.g., john@examplebank).

d. Enter the amount you want to transfer.

e. Add a remark or note for the transaction (optional).

f. Select the bank account from which you want to make the payment (if you have linked multiple bank accounts).

g. Review the transaction details & ensure they are accurate.

4.Enter UPI PIN & Confirm:

a. To authorize the transaction, you be will prompted to enter your UPI PIN.

b. Enter the UPI PIN, and the app will process the transaction.

c. Once the transaction is successful, you will receive a confirmation message or notification. You and the recipient will receive SMS notifications /or in-app notifications about the transaction.

The role of the UPI Age in India

Unified Payments Interface (UPI) has become a crucial part of the digital payment landscape in our country.

Convenience: UPI offers a seamless & user-friendly way to make payments & transfer funds. Users can link their bank account to a UPI-enabled app & make transactions with just a few clicks on their mobile devices.

Security: UPI transactions are secured with multi-factor authentication, UPI PIN, including mobile PIN, fingerprint, or biometric authentication. This ensures that users' financial data remains safe and secure.

Cashless Economy: UPI has played a significant role in the push towards a cashless economy, reducing the reliance on physical cash and promoting digital financial transactions.

Financial Inclusion: UPI has made it easier for people in the remote or underserved areas to access and use digital financial services. It has played a crucial role in the financial inclusion by bringing banking and payment services to a wider population.

Innovation: UPI has paved the way for fintech innovation, with various third-party apps and services building on the UPI infrastructure to offer innovative financial products and services to users.

.png)

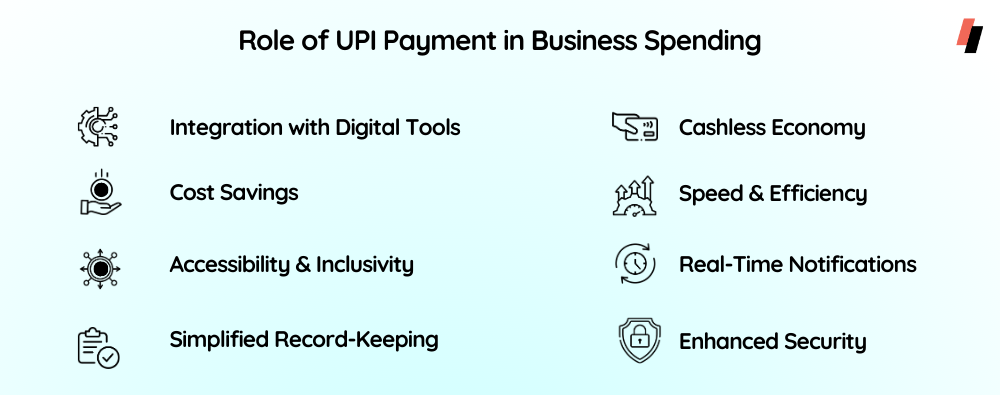

Role of UPI Payment in Business Spending

Traditional payment methods are giving way to innovative solutions that are faster, more secure, and more efficient. One such game-changer is UPI (Unified Payments Interface), which has revolutionized the way businesses manage their spending.

Speed and Efficiency

One of the most significant advantages of UPI payments for business spending is speed and efficiency. Unlike traditional methods such as checks or bank transfers, UPI allows businesses to make instantaneous payments. This speed is crucial in a world where time is money. Businesses can settle bills, pay suppliers, and execute transactions in real-time, thus reducing delays and ensuring that their operations run smoothly.

Cost Savings

Cost reduction is another compelling reason why businesses are embracing UPI transaction. Traditional payment methods often come with associated fees, such as wire transfer charges or check processing costs. With UPI, many transactions are either free or have nominal fees, reducing the financial burden on businesses. This results in substantial cost savings in the long run, which can be invested in other areas of the business.

Enhanced Security

Security is a paramount concern for businesses when it comes to financial transactions. UPI transactions are highly secure. They require multi-factor authentication, including UPI PIN and biometrics, ensuring that only authorized personnel can initiate and complete transactions. The end-to-end encryption of UPI transactions adds an extra layer of protection, safeguarding sensitive financial data.

Simplified Record-Keeping

Businesses deal with numerous transactions daily, and keeping track of all of them can be a daunting task. UPI payments offer a solution to this problem by providing digital records of all transactions. Businesses can easily access the transaction history, making it convenient for accounting and reconciliation. This simplifies record-keeping and reduces the chances of errors in financial reporting.

Accessibility and Inclusivity

A UPI transaction is accessible to a vast majority of the population, including businesses in rural and remote areas. It doesn't discriminate based on geographical location or the size of the business. This inclusivity is essential for businesses looking to expand their reach and engage with a diverse customer base. It's also an effective tool for B2B transactions, as it allows businesses to interact with a wide range of suppliers and partners.

Integration with Digital Tools

Another benefit of the UPI payment setup is its seamless integration with various digital tools and software. Businesses can easily link their UPI accounts to accounting software, ERP systems, and other financial management platforms. This integration streamlines financial operations, reduces manual data entry, and minimizes the risk of errors.

Real-Time Notifications

UPI transactions provide real-time notifications, keeping businesses updated on the status of their payments. This feature is crucial for maintaining transparency and ensuring that payments are processed correctly and on time. It also allows businesses to detect and address any discrepancies or issues promptly.

Cashless Economy

As the world moves toward a cashless economy, UPI is at the forefront of the transition. Businesses that adopt the UPI system can offer their customers a convenient and modern payment method, which can lead to increased sales and customer satisfaction. In a cashless ecosystem, businesses can operate efficiently, reduce the risk of theft, and minimize the need for physical cash management.

Transforming Indian Small Businesses: The UPI Revolution

In recent years, India has witnessed a significant transformation in its digital payment landscape. One of the most impactful developments has been the introduction of the Unified Payments Interface (UPI). UPI has revolutionized the way Indians conduct financial transactions, and its impact on small businesses is particularly noteworthy.

Streamlined Payments

The UPI system allows small businesses to accept payments in a seamless and efficient manner. Customers can make payments through various UPI-based apps, which eliminates the need for cash transactions or card swipes. This has not only accelerated the payment process but has also reduced the hassle of handling and counting cash for small businesses.

Cost-Effective Solution

Accepting digital payments through UPI is cost-effective for small businesses. Unlike traditional point-of-sale (POS) systems or credit card machines that often involve setup costs and monthly fees,the UPI transactions typically have lower processing fees. This makes it an affordable solution for small businesses, which often operate on tight budgets.

Increased Customer Reach

With UPI, small businesses can extend their customer reach beyond their physical location. Customers can make payments remotely, which is especially beneficial during times like the COVID-19 pandemic when footfall might be restricted. Additionally, UPI-enabled apps often have features that allow businesses to showcase their products or services, further enhancing their online presence.

Digital Record-Keeping

UPI transactions provide small businesses with a digital trail of all payments received. This record-keeping not only simplifies accounting but also facilitates transparency. For tax purposes, it becomes easier to maintain accurate financial records and reconcile accounts.

Improved Cash Flow Management

Cash flow is critical for small businesses. With UPI, funds are transferred directly to a designated bank account, ensuring a smoother cash flow management process. Businesses can access their money faster, reducing the need to chase outstanding payments and improving liquidity.

Reduced Risk of Fraud

Cash transactions are susceptible to theft and fraud. UPI transactions are more secure, with multiple layers of authentication, making it difficult for fraudulent activities to occur. This enhanced security is especially advantageous for small businesses that handle cash regularly.

Better Inventory Management

The digital nature of UPI transactions allows small businesses to keep track of inventory more efficiently. As transactions are recorded in real-time, businesses can monitor which products are selling well and adjust their inventory accordingly. This data-driven approach can help prevent overstocking or understocking.

Enhanced Customer Experience

The convenience of UPI payment enhances the overall customer experience for small businesses. It offers customers a hassle-free and secure payment method, which can lead to increased loyalty and repeat business.

Adaptability & Innovation

The UPI ecosystem in our country continues to evolve and innovate. Small businesses can benefit from these advancements, such as UPI-based QR codes, recurring payments, and more. Staying updated with these developments can provide a competitive advantage.

UPI has had a profound impact on small businesses in our country. From streamlining payments to enhancing customer experiences, UPI is transforming the way small businesses operate. As the digital payment ecosystem continues to evolve, small businesses that embrace UPI will likely enjoy a competitive edge and thrive in an increasingly digital world. UPI is not just a payment method; it's a catalyst for growth and efficiency for small businesses across India.

Navigating the Modern Business Spend Landscape

With the advent of digital technology, there is a growing need for businesses to embrace digital intervention in their B2B spend landscape.

Real-time Visibility

Traditional B2B spending processes often involve a paper trail, making it difficult to gain real-time insights into spending patterns. Digital intervention offers real-time visibility into spending, enabling businesses to track expenses as they happen. With the help of advanced software and analytics, companies can quickly identify trends, areas of overspending, and potential cost-saving opportunities. This real-time data empowers decision-makers to make informed choices promptly.

Cost Efficiency

Digital intervention can significantly reduce administrative costs associated with B2B spending. Automation of tasks such as invoice processing, purchase order management, and payment approvals streamlines the entire process. Additionally, digital solutions can help identify potential cost-saving opportunities through better negotiation with suppliers, contract management, and improved inventory control.

Enhanced Data Accuracy

Manual data entry is prone to errors and inconsistencies, which can lead to financial discrepancies and lost revenue. Digital intervention ensures higher data accuracy through automated processes, reducing the chances of mistakes. Accurate data is vital for financial reporting, auditing, and ensuring compliance with industry standards and regulations.

Improved Supplier Relationships

Strong relationships with suppliers are essential for any business. Digital intervention can enhance these relationships by providing better communication channels and transparency. For example, digital procurement platforms allow suppliers to receive orders, confirm deliveries, and track payments online. This leads to increased trust and smoother collaboration, resulting in better terms and cost savings.

Strategic Decision-Making

With access to real-time data and insights, businesses can make strategic decisions to optimize their B2B spending. Digital tools enable better forecasting, demand planning, and scenario analysis. This helps companies adjust their strategies in response to market changes, economic fluctuations, or shifts in customer preferences.

Compliance and Risk Management

Regulatory compliance and risk management are paramount in the B2B spending landscape. Digital intervention facilitates adherence to industry standards and regulations by providing accurate records and audit trails. Moreover, it allows companies to monitor and manage risks associated with suppliers, contracts, and procurement processes, reducing the potential for costly legal or financial issues.

Scalability

Digital intervention in B2B spending is highly scalable, making it suitable for businesses of all sizes. Whether you're a small startup or a large corporation, digital solutions can be tailored to meet your specific needs. As your business grows, these tools can evolve to accommodate your changing requirements and expanding supplier networks.

Sustainability

Sustainability is an increasingly important consideration for businesses worldwide. Digital intervention in B2B spending can support sustainability efforts by promoting eco-friendly practices. It can help businesses identify sustainable suppliers, reduce waste through optimized inventory management, and track the carbon footprint of the supply chain.

The business spend landscape is undergoing a digital transformation, and for good reason. In an era of rapid change and fierce competition, digital tools and technologies offer a clear advantage to those who utilize them, making the case for their adoption in the B2B spend landscape stronger than ever. As the business world continues to evolve, companies that prioritize digital intervention in their B2B spending will be better positioned to thrive and adapt to whatever challenges lie ahead.

Streamlining Your Business Finances: Take the UPI x Spend Management Road

What if you could take the UPI experience to the next level? That's where spend management comes into play. Let's explore the synergy between UPI payments and spend management, and how this combination can enhance your financial control and efficiency.

First let's find out what is Spend Management.

Spend management is a comprehensive approach to controlling and optimizing an individual or organization's expenses. It involves tracking, analyzing, and managing all financial transactions to gain insights into where and how money is being spent. By implementing spend management, individuals and businesses can make informed decisions about budgeting, cost-cutting, and improving financial efficiency.

The UPI revolution in Spend Management

Real-time Expense Tracking

UPI transactions are recorded instantly in your bank account. This real-time record-keeping makes it easier to track your expenses as they occur. With spend management tools or apps, you can categorize and organize these transactions, helping you gain a clear understanding of your spending habits.

Centralized Financial Management

UPI is highly versatile, allowing you to pay for a wide range of services and products. When you integrate UPI with a spend management system, you can centralize all your financial activities in one place. This not only simplifies your financial life but also enables you to have a holistic view of your income and expenditures.

Data-Driven Decision Making

By combining UPI and spend management, you can access valuable data and insights about your financial behavior. These insights can help you make informed decisions about your spending, saving, and investment strategies.

Expense Control

UPI payments are easy and convenient, which can sometimes lead to impulsive spending. A spend management system can set spending limits and alerts to help you stay within your budget and avoid overspending.

Streamlined Business Expenses

For businesses, UPI integrated with spend management offers an efficient way to manage expenses, reimburse employees, and gain insights into corporate spending patterns. This can improve financial accountability and transparency within the organization.

Fraud Protection

UPI transactions are secure, but adding a spend management layer can provide an extra level of security. By monitoring all transactions in real-time, you can quickly detect and respond to any suspicious activity.

The combination of UPI payments and spend management is a powerful way to take control of your finances. It provides the convenience and security of UPI while adding a layer of financial management and control. Whether you're an individual looking to manage your personal expenses or a business aiming to optimize your finances, integrating UPI with spend management can help you make better financial decisions, save money, and achieve your financial goals.

Explore OmniCard Spend Management with UPI Payments

Real-Time Tracking:

OmniCard Spend Management with UPI offers real-time tracking of all financial transactions, enabling businesses to monitor their expenses as they happen. This ensures greater transparency & control over company spending.

Complete Visibility:

With OmniCard, businesses gain complete visibility into their expenditure. The platform provides detailed insights into where funds are being allocated, allowing for data-driven decision-making & budget planning.

Prepaid Corporate Cards:

This solution includes prepaid corporate cards that empower companies to streamline their expense management processes. These cards can be easily allocated to employees, making it convenient to control and monitor individual spending.

Petty Cash Management:

OmniCard simplifies the management of the petty cash system. Businesses can allocate specific amounts to various departments or employees, & these funds can be accessed through prepaid cards or UPI payments, reducing the hassle associated with traditional petty cash handling.

Easy Reimbursements & Cash Flow Optimization:

OmniCard facilitates efficient reimbursement processes. Employees can submit expenses easily, & managers can quickly approve & process these requests. This not only enhances employee satisfaction but also optimizes cash flow by ensuring prompt reimbursements.

Incorporating OmniCard Spend Management with UPI into your financial management strategy can enhance financial control, reduce administrative overhead, and contribute to a more efficient & transparent spending ecosystem for your organization. OmniCard spend management + UPI payments is a powerful combination that empowers businesses with Digital First Solutions, Book a Free Trial Today

UPI without a Bank Account with OmniCard

OmniCard offers a unique business payment solution that allows users to make UPI payments without the need for a traditional bank account to be linked. OmniCard is directly licensed by the Reserve Bank of India for Prepaid Payment Instruments. OmniCard empowers businesses to seamlessly send & receive UPI payments, mirroring the convenience of the traditional bank account, all without the complexities associated with banking institutions. This streamlined approach simplifies day-to-day expense management & ensures swift & hassle-free onboarding, catering to the evolving needs of modern businesses.