What Is the P2P Cycle? Best-Practices for Businesses

- Best Practices

- Finance

- 07-May-24

What is Procurement?

Procurement is the process of finding, acquiring, and buying goods, services, or works from an external source. It involves determining the requirements, selecting the vendor or supplier, negotiating contracts, and ensuring timely delivery and payment.

Effective procurement is crucial for businesses to obtain the right goods and services at the best possible price, quality, and terms to meet their needs.

Efficiency Through Strategic Sourcing

Procurement's primary objective is to obtain goods and services at the best possible price, quality, and terms. This process, known as strategic sourcing, involves analyzing spend data, identifying cost-saving opportunities, negotiating contracts, and managing supplier relationships. By strategically sourcing goods and services, organizations can achieve significant cost reductions, streamline operations, and improve overall efficiency.

Risk Management and Compliance

Procurement also plays a critical role in managing risks and ensuring compliance with laws and regulations. By conducting thorough supplier assessments and due diligence, organizations can mitigate risks related to supplier financial stability, ethical practices, and compliance with environmental and social standards. Additionally, procurement helps organizations adhere to regulatory requirements, safeguarding against legal issues and reputational damage.

Driving Innovation Through Procurement

Procurement is not just about cost containment; it is also a catalyst for innovation. By engaging with a diverse range of suppliers and staying abreast of market trends, procurement professionals can identify innovative products, services, and technologies that can drive business growth and differentiation. Procurement's involvement in the early stages of product development can lead to the introduction of innovative solutions that meet evolving customer needs.

Sustainability and Corporate Social Responsibility (CSR)

In recent years, there has been a growing emphasis on sustainability and CSR in procurement practices. Organizations are increasingly expected to source products and services ethically and sustainably, considering environmental and social impacts. Procurement plays a crucial role in selecting suppliers that align with these values, thereby contributing to a more sustainable and responsible supply chain.

Supplier Relationship Management: Best Practices for Success

1. Develop a Clear SRM Strategy

Start by defining your organization's goals and objectives for supplier relationships. Determine the key suppliers critical to your operations and prioritize them based on their strategic importance. Develop a roadmap for managing these relationships, outlining the desired outcomes and metrics for success.

2. Establish Strong Communication Channels

Effective communication is key to building strong supplier relationships. Establish regular communication channels to keep suppliers informed about your organization's requirements, expectations, and performance metrics. Encourage open dialogue and feedback to address issues promptly and foster collaboration.

3. Build Trust and Collaboration

Focus on building trust and collaboration with your suppliers. Treat them as strategic partners rather than transactional vendors. Involve suppliers early in the product development process to leverage their expertise and drive innovation. Recognize and reward suppliers for outstanding performance to incentivize continued excellence.

4. Implement Robust Performance Measurement

Develop a set of key performance indicators (KPIs) to measure supplier performance objectively. These KPIs should align with your organization's goals and objectives, covering areas such as quality, delivery, cost, and innovation. Regularly review and analyze supplier performance data to identify areas for improvement and recognize achievements.

5. Conduct Regular Supplier Reviews

Schedule regular supplier performance reviews to discuss performance against KPIs, address any issues or concerns, and identify opportunities for improvement. These reviews should be collaborative and constructive, focusing on how both parties can work together to enhance performance and achieve mutual success.

6. Manage Risks Proactively

Identify and assess risks associated with your key suppliers, including financial, operational, and geopolitical risks. Develop risk mitigation strategies to minimize the impact of these risks on your organization. Maintain a diverse supplier base to reduce dependency on a single supplier and enhance supply chain resilience.

7. Embrace Technology

Leverage technology to streamline and automate your SRM processes. Use supplier management software to centralize supplier information, track performance metrics, and facilitate communication. Implement e-procurement systems to improve efficiency in sourcing and procurement processes.

8. Continuously Improve

SRM is an ongoing process that requires continuous improvement. Regularly review and update your SRM strategy to adapt to changing business conditions and supplier landscapes. Solicit feedback from suppliers and internal stakeholders to identify areas for improvement and implement best practices.

What is Procure-to-Pay Process?

The procure-to-pay system is a comprehensive solution that encompasses all steps from procurement to payment, offering control, validation, risk mitigation, and scalability. Procure-to-Pay (P2P) is a process that streamlines the entire procure to pay cycle within an organization.

It involves all steps from the procurement of goods and services to the payment of suppliers, encompassing the entire procurement lifecycle, starting from the identification of a need, through the selection of suppliers, purchase order creation, goods receipt, invoice verification, and finally, payment processing.

Efficient P2P processes are crucial for organizations to manage their spend effectively, ensure compliance with policies and regulations, and maintain strong supplier relationships. The benefits and key stages of the procure-to-pay process highlight its role in managing purchasing processes and providing control and visibility. Here’s a breakdown of the key stages in the Procure-to-Pay process:

Need Identification: The process begins when a department identifies a need for goods or services. This could be triggered by low inventory levels, new project requirements, or routine maintenance.

Requisition: A formal request, known as a purchase requisition, is created and submitted for approval. This document specifies the details of the required goods or services, including quantity, specifications, and delivery requirements.

Supplier Selection: Once the requisition is approved, the procurement team identifies potential suppliers and evaluates them based on factors such as price, quality, and delivery capabilities. A purchase order (PO) is then created and sent to the selected supplier.

Purchase Order Processing: Upon receiving the PO, the supplier acknowledges the purchase order and begins processing it. The PO serves as a legal contract between the buyer and the supplier, outlining the terms and conditions of the purchase.

Goods Receipt: When the goods or services are delivered, the receiving department checks them against the PO to ensure they meet the specified requirements. A goods receipt note (GRN) is created to confirm the receipt of goods.

Invoice Verification: Once the goods receipt is confirmed, the supplier submits an invoice for payment. The invoice is matched against the PO and GRN to verify the accuracy of the charges.

Payment Processing: After the invoice is verified, it is approved for payment. Depending on the payment terms negotiated with the supplier, payment is made either by check, electronic funds transfer (EFT), or another agreed-upon method.

Reporting and Analysis: Throughout the P2P process, data is collected and analyzed to track spending, monitor supplier performance, and identify opportunities for cost savings and process improvements.

Procure-to-pay software solutions can automate and streamline the P2P process, improving efficiency, compliance, and control over procurement and payment activities.

Benefits of a Well-Managed P2P Process:

Improved cost control and spend visibility

Enhanced compliance with policies and regulations

Streamlined and efficient procurement operations

Stronger supplier relationships and better negotiation outcomes

Increased transparency and accountability in purchasing activities

What is the Procure to Pay Cycle?

The Procure-to-Pay (P2P) cycle, also known as the Purchase-to-Pay process, is a series of steps that organizations follow to acquire goods and services from suppliers and pay for them.

It involves several key stages, each of which plays a critical role in ensuring that procurement activities are conducted efficiently and effectively.

The Steps in a P2P Cycle

Identifying the Need: The P2P cycle begins with identifying the need for a product or service. This can be triggered by various factors such as inventory levels, production requirements, or requests from internal stakeholders.

Requisitioning: Once the need is identified, a requisition is created. A requisition is a formal request for the purchase of goods or services, detailing the specifications, quantity, and delivery requirements. The requisition is then submitted for approval.

Approval: The requisition is reviewed and approved by authorized personnel, such as department heads or budget managers. Approval ensures that the purchase is in line with organizational policies and budget constraints.

Supplier Selection: After approval, the procurement team identifies and selects suitable suppliers. This involves evaluating suppliers based on factors such as price, quality, reliability, and past performance.

Purchase Order (PO) Creation: Once a supplier is selected, a purchase order (PO) is created. The PO outlines the details of the purchase, including the product or service description, quantity, price, delivery terms, and payment terms. The PO is then sent to the supplier.

Order Confirmation: Upon receiving the PO, the supplier confirms the order details, including the delivery date and any other relevant information. This confirmation ensures that both parties are aligned on the terms of the purchase.

Goods Receipt: When the goods or services are delivered, the receiving department verifies the delivery against the PO to ensure that the correct items and quantities have been received. Any discrepancies are noted and addressed with the supplier.

Invoice Processing: Once the goods or services are received and verified, the supplier sends an invoice to the buyer. The invoice is matched against the PO and the goods receipt to ensure accuracy.

Invoice Approval: The invoice is reviewed and approved for payment by authorized personnel. This step ensures that the invoice is accurate and in accordance with the PO and goods receipt.

Payment: After approval, payment is made to the supplier based on the agreed-upon terms. Payment can be made through various methods, such as electronic funds transfer (EFT) or cheque.

Supplier Performance Evaluation: After the transaction is completed, the supplier's performance is evaluated based on factors such as delivery time, quality of goods or services, and adherence to terms and conditions. This evaluation helps in maintaining a healthy supplier relationship and improving future procurement processes.

Benefits of Implementing an efficient P2P cycle

There are several key benefits to implementing an efficient Procure-to-Pay (P2P) cycle in your organization.

Optimizing the procure-to-pay process flow is crucial for streamlining operations, increasing cost savings, creating scalability, and improving inventory management, by standardizing each step, identifying desired outcomes, and tailoring the flow to specific company requirements.

Cost Savings

An efficient P2P cycle streamlines procurement processes by eliminating manual work and automating workflows. This reduces processing costs and frees up employees to focus on more strategic tasks.

Improved Cash Flow

By automating invoice processing and payment approvals, you can gain better control over your cash flow. This allows you to take advantage of early payment discounts offered by vendors and frees up cash for other purposes.

Operational Visibility

An efficient P2P cycle provides real-time visibility into everything that happens from the moment a requisition is raised to the final payment. This transparency allows for better tracking and monitoring of spending, improved budget adherence, and ensures compliance with regulations.

Stronger Supplier Relationships

Efficient P2P processes foster collaboration and build trust with your suppliers. Faster invoice processing and on-time payments improve supplier satisfaction and can lead to better pricing and terms.

Reduced Errors

Manual data entry is a major source of errors in the procurement process. Automating workflows can significantly reduce these errors, leading to faster processing times and fewer headaches.

The Procurement Strategy for Modern Businesses

Alignment with Business Goals: The procurement strategy should align with the overall business objectives and support the organization's long-term growth plans. It should focus on delivering value beyond cost savings, such as driving innovation, improving quality, and enhancing customer satisfaction.

Supplier Relationship Management: Establishing strong and collaborative relationships with suppliers is critical. The procurement strategy should include initiatives to identify, select, and manage suppliers based on their ability to deliver value, quality, and innovation.

Risk Management: Identify and mitigate risks associated with the supply chain, such as supply disruptions, quality issues, and geopolitical factors. Develop strategies to diversify the supplier base, ensure continuity of supply, and manage potential disruptions effectively.

Digital Transformation: Embrace digital technologies to streamline procurement processes, enhance visibility into spend, and improve decision-making. Implementing e-procurement tools, automation, and analytics can drive efficiency and enable data-driven insights.

Supplier Diversity: Promote supplier diversity by sourcing from a wide range of suppliers, including small and minority-owned businesses. This not only supports economic growth but also fosters innovation and competitiveness.

Performance Measurement: Define key performance indicators (KPIs) to measure the effectiveness of the procurement strategy. Monitor KPIs regularly and use the data to drive improvement and make informed decisions.

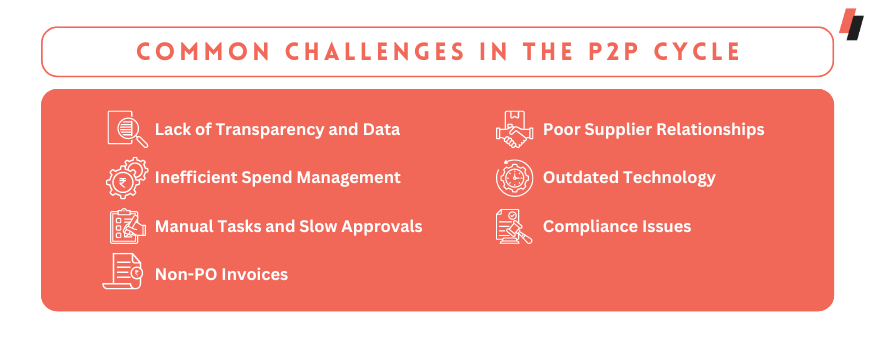

Common challenges in the P2P cycle

The Procure-to-Pay (P2P) cycle, while crucial for business efficiency, can be plagued by several challenges. Here are some of the most common ones:

Lack of Transparency and Data

Siloed systems and manual processes make it difficult to track spending and identify areas for improvement. Information isn't readily available, hindering informed decision-making.

Manual Tasks and Slow Approvals

Paper-based processes and manual approvals create bottlenecks and slow down the entire P2P cycle. This can lead to delays in receiving goods or services, and missed opportunities for early payment discounts.

Non-PO Invoices

Invoices that don't match a purchase order (PO) create a roadblock as they require additional verification and processing steps. This can be caused by maverick buying (unauthorized purchases) or supplier errors.

Inefficient Spend Management

Without proper visibility into spending habits, it's difficult to control costs and optimize budgets. Organizations may struggle to negotiate better deals with suppliers or identify unnecessary spending.

Poor Supplier Relationships

Delays in invoice processing and payments can damage supplier relationships. This can lead to unreliable deliveries, higher prices, and decreased supplier satisfaction.

Outdated Technology

Reliance on outdated software or manual processes can hinder automation and make the P2P cycle less efficient.

Compliance Issues

Manual processes increase the risk of errors and non-compliance with regulations. This can lead to fines and reputational damage.

Key performance indicators (KPIs) for monitoring the P2P cycle

Efficiency KPIs:

Purchase Order (PO) cycle time: This measures the average time it takes to complete a purchase order, from requisition to issuance. A shorter cycle time indicates a more streamlined process.

Invoice processing time: This tracks the average time it takes to process an invoice from receipt to payment. Faster processing times improve cash flow and supplier relationships.

Error rate: This measures the percentage of invoices with errors that require additional work. A low error rate indicates efficient data entry and matching processes.

Percentage of invoices processed electronically: This shows the level of automation in your P2P cycle. A higher percentage indicates a more efficient and paperless process.

Cost and Savings KPIs:

Cost per invoice: This tracks the average cost associated with processing an invoice. Lower costs indicate efficient use of resources.

Early payment discounts captured: This measures the percentage of invoices paid early to take advantage of supplier discounts. A higher percentage reflects successful utilization of these savings opportunities.

Maverick spending: This tracks unauthorized purchases outside of approved procurement channels. Reduced maverick spending indicates better control over costs.

Compliance KPIs:

Percentage of invoices paid on time: This measures adherence to payment terms and avoids late payment penalties.

Compliance with supplier contracts: This tracks adherence to agreed-upon terms with suppliers, minimizing contractual disputes.

Supplier Relationship KPIs:

Perfect order fulfillment rate: This measures the percentage of orders delivered on time, complete, and accurate. A higher rate indicates strong supplier performance.

Supplier satisfaction score: This gauges supplier perception of your procurement processes, such as communication and payment times. High satisfaction reflects positive supplier relationships.

.png)

Best practices for optimizing the P2P Cycle

Optimizing the procure-to-pay (P2P) cycle is crucial for businesses looking to streamline their procurement processes, improve operational efficiency, and reduce costs. This cycle encompasses all activities involved in obtaining goods or services, from the initial requisition to the final payment.

By implementing best practices, organizations can enhance transparency, control, and compliance throughout the P2P cycle.

Here are some key strategies for optimizing the P2P process:

Centralize Procurement: Centralizing procurement activities can help consolidate purchasing power, standardize processes, and negotiate better terms with suppliers. This approach enables better visibility and control over spending, leading to cost savings and improved efficiency.

Automate Procurement Processes: Leveraging technology to automate procurement processes, such as purchase requisitions, approvals, and purchase orders, can significantly reduce manual errors and processing times. Automated systems also provide real-time visibility into the status of orders and enable better decision-making.

Implement Purchase Controls: Establishing robust purchase controls, such as approval workflows and spending limits, can help prevent unauthorized purchases and ensure compliance with company policies and regulations. These controls also help in managing cash flow and optimizing working capital.

Vendor Management: Developing strong relationships with vendors is essential for optimizing the P2P cycle. Regularly evaluating vendor performance, negotiating favorable terms, and consolidating spend with preferred suppliers can lead to cost savings and improved service levels.

Enforce Compliance: Ensuring compliance with internal policies, industry regulations, and contractual agreements is critical for optimizing the P2P cycle. Implementing tools and processes to monitor compliance can help mitigate risks and avoid costly penalties.

Use Electronic Payments: Switching to electronic payments, such as electronic funds transfers (EFT) or virtual credit cards, can streamline the payment process, reduce processing costs, and improve visibility into cash flow. Electronic payments also enhance security and reduce the risk of fraud.

Continuous Improvement: Regularly reviewing and analyzing the P2P process for inefficiencies and bottlenecks is essential for continuous improvement. Implementing feedback loops and conducting post-implementation reviews can help identify areas for optimization and enhance overall process effectiveness.

Invest in Training: Providing training to employees involved in the P2P process can improve their understanding of the process, increase compliance with policies, and reduce errors. Training can also help employees leverage technology effectively to optimize the P2P cycle.

Optimizing the procure-to-pay cycle requires a holistic approach that involves centralizing procurement, automating processes, implementing controls, managing vendors effectively, ensuring compliance, using electronic payments, focusing on continuous improvement, and investing in training.

By following these best practices, organizations can streamline their procurement processes, reduce costs, and improve efficiency and effectiveness across the P2P cycle.

What is 3-way matching in P2P?

Three-way matching is a process used in Procure-to-Pay (P2P) to verify that a supplier invoice matches the corresponding purchase order (PO) and goods receipt (GR).

The goal of three-way matching is to ensure that the organization is paying the correct amount for goods or services received, based on the terms agreed upon with the supplier. Here's how the three-way matching process works:

Purchase Order (PO):

The process begins when a purchase order is created and sent to the supplier. The PO specifies the details of the goods or services to be purchased, including quantity, price, and delivery terms.

Goods Receipt (GR):

When the goods or services are delivered, the receiving department checks them against the PO to verify that they match the order. A goods receipt is created to confirm the receipt of the goods.

Invoice:

The supplier sends an invoice for the goods or services provided. The invoice should match the details specified in the PO and the goods receipt. It includes the quantity, price, and other relevant information.

Matching Process

In the three-way matching process, the PO, GR, and invoice are compared to ensure that all three documents match. The following scenarios can occur:

Three-Way Match:

If the details on the invoice match the PO and GR, a three-way match is achieved. The invoice is approved for payment.

Two-Way Match:

If there is a discrepancy between the invoice and the GR, a two-way match may be performed, comparing the invoice directly to the PO. If the discrepancy is resolved, the invoice can be approved for payment.

No Match:

If the details on the invoice do not match the PO or GR, the invoice is flagged for review, and further investigation is required to resolve the discrepancy before payment can be made.

Approval and Payment:

Once the three-way match is completed and any discrepancies are resolved, the invoice is approved for payment. Payment is then processed according to the agreed-upon terms with the supplier.

The Role of Technology in P2P Transformation

Digital Platforms: Technology has enabled the creation of digital platforms that facilitate P2P transactions. These platforms provide the infrastructure for individuals or businesses to connect and transact directly, bypassing traditional intermediaries.

Blockchain and Cryptocurrencies: Blockchain technology has revolutionized P2P transactions by providing a secure and decentralized way to record transactions. Cryptocurrencies like Bitcoin and Ethereum enable direct P2P transfers without the need for banks or other financial institutions.

Mobile Payments: The proliferation of smartphones has made it easier for individuals to make P2P payments using mobile payment apps. These apps allow users to transfer money to friends, family, or businesses with just a few taps on their phone.

Big Data and AI: Big data analytics and artificial intelligence (AI) are being used to analyze user behavior and preferences, allowing companies to offer more personalized P2P services. This enhances the user experience and increases engagement.

Security and Fraud Prevention: Technology has also improved the security of P2P transactions by implementing advanced encryption techniques and fraud detection algorithms. This has helped build trust among users and reduce the risk of fraud.

Efficiency and Cost Reduction: By automating processes and eliminating intermediaries, technology has made P2P transactions more efficient and cost-effective. This has led to lower transaction fees and faster processing times.

Financial Inclusion: Technology has played a crucial role in promoting financial inclusion by providing access to P2P financial services to underserved populations. Mobile banking and payment apps have made it easier for people in remote areas to access financial services.

The Power of an Optimized P2P Cycle

An optimized peer-to-peer (P2P) cycle can bring numerous benefits to individuals and businesses alike. Here's a look at some of the key advantages:

Efficiency: A well-optimized P2P cycle streamlines the entire process, from initiating a transaction to receiving payment. This efficiency leads to faster transactions, reduced processing times, and improved overall productivity.

Cost Savings: By eliminating intermediaries and reducing manual processes, an optimized P2P cycle can result in significant cost savings. This includes lower transaction fees, reduced administrative costs, and fewer errors that require correction.

Improved Cash Flow: Optimizing the P2P cycle can help improve cash flow by ensuring that payments are processed and received in a timely manner. This can help businesses better manage their finances and avoid cash flow issues.

Enhanced Visibility and Control: An optimized P2P cycle provides better visibility into the entire process, allowing businesses to track payments, monitor performance, and identify areas for improvement. This enhanced visibility also helps businesses maintain greater control over their finances.

Reduced Risk of Fraud: By implementing robust security measures and authentication protocols, an optimized P2P cycle can reduce the risk of fraud and unauthorized transactions. This helps protect businesses and individuals from financial losses and reputational damage.

Better Supplier Relationships: A streamlined P2P cycle can lead to improved relationships with suppliers. Timely payments and efficient communication can help build trust and loyalty, leading to better terms and conditions for future transactions.

Compliance and Risk Management: An optimized P2P cycle ensures compliance with regulatory requirements and internal policies. This reduces the risk of non-compliance and potential penalties, while also improving overall risk management practices.

Scalability: An optimized P2P cycle is scalable, allowing businesses to easily adapt to changing business needs and transaction volumes. This scalability ensures that the P2P process remains efficient and effective as the business grows.

Optimizing the P2P cycle can lead to numerous benefits, including improved efficiency, cost savings, enhanced cash flow, and better relationships with suppliers. By focusing on streamlining processes, implementing robust security measures, and leveraging technology, businesses can maximize the power of an optimized P2P cycle.

Optimize Better with Spend Management

Centralized Platform

A BSM solution provides a centralized platform for managing all aspects of the P2P cycle, including purchasing, invoicing, and payments. This streamlines the entire process and improves visibility and control.

Automation

BSM solutions automate many manual tasks involved in the P2P cycle, such as invoice processing, approval workflows, and payment reconciliation. This improves efficiency and reduces the risk of errors.

Spend Visibility

BSM solutions provide detailed insights into spending patterns and trends, allowing organizations to make more informed decisions and identify cost-saving opportunities.

Compliance

BSM solutions help ensure compliance with internal policies and external regulations by enforcing approval workflows and providing audit trails for all transactions.

Supplier Management

BSM solutions help organizations manage their relationships with suppliers more effectively by providing tools for tracking performance, negotiating contracts, and managing supplier information.

Cost Savings

By streamlining processes, reducing errors, and improving visibility, BSM solutions can help organizations save money on their P2P operations.

Scalability

BSM solutions are scalable and can easily adapt to the changing needs of organizations as they grow and evolve.

Integration

BSM solutions can integrate with other systems, such as ERP systems, to provide a seamless end-to-end P2P process.