Petty Cash Management: What is Petty Cash, benefits of Petty Cash & More

- Business Solutions

- Spend Management

- 04-Dec-23

What is Petty Cash?

Petty cash is a small fund of cash that a business maintains for day-to-day expenses and minor transactions from the petty cash account. Petty cash is a vital aspect of Business spend management. A Petty Cash Custodian is responsible for managing a fund used for minor expenses in an organization. The Custodian maintain records, disburse funds, and ensures proper documentation.

What is Petty Cash Management?

Petty cash management is a crucial aspect of financial control and accountability within organizations. It involves the systematic handling and tracking of small, day-to-day expenses, allowing businesses to efficiently manage their finances.

In essence, a petty cash fund is a small, readily available typically kept on hand for routine expenses such as office supplies, postage, or minor emergency purchases. A petty cash system necessitates a well-defined management system for all petty cash available. First, The Custodian is designated and The Custodian is responsible for safeguarding & administering a petty cash fund. This individual is tasked with ensuring that the cash is secure & disbursed only for legitimate business expenses.

To maintain transparency and accountability, all transactions involving petty cash should be documented. This includes receipts, invoices, or expense reports, with each transaction recorded in the petty cash ledger. Regular reconciliations are crucial to track the fund's balance and replenish it as needed. This practice ensures that all petty cash remains available for operational needs without any misuse or loss.

Proper management not only simplifies the financial process but also reduces the risk of misappropriation or fraud. It promotes financial discipline and accountability, making it an indispensable component of effective financial management in both small businesses and larger organizations.

Examples of Petty Cash

Here are some examples:

Office Supplies: Purchasing items like pens, notepads, paperclips, and other office supplies.

Postage and Mailing: Paying for postage to send letters and packages.

Employee Reimbursements: Providing funds to employees for small, out-of-pocket expenses that can't be covered by a company credit card, such as parking fees, tolls, or meals while travelling for business.

Snacks and Refreshments: Buying coffee, tea, snacks, or drinks for office pantry or break room.

Minor Repairs and Maintenance: Covering small expenses for office maintenance or repairs, such as replacing a broken doorknob or lightbulb.

Transportation Costs: Paying for taxi or subway fares for employees when they need to travel for business purposes.

Courier Services: Paying for courier or delivery services.

Office Equipment Supplies: Purchasing printer cartridges, cleaning supplies, or other items necessary to maintain office equipment.

Parking Fees: Covering parking fees for employees or visitors when required for business activities.

Minor Office Decorations: Buying decorations or small items for office events or celebrations.

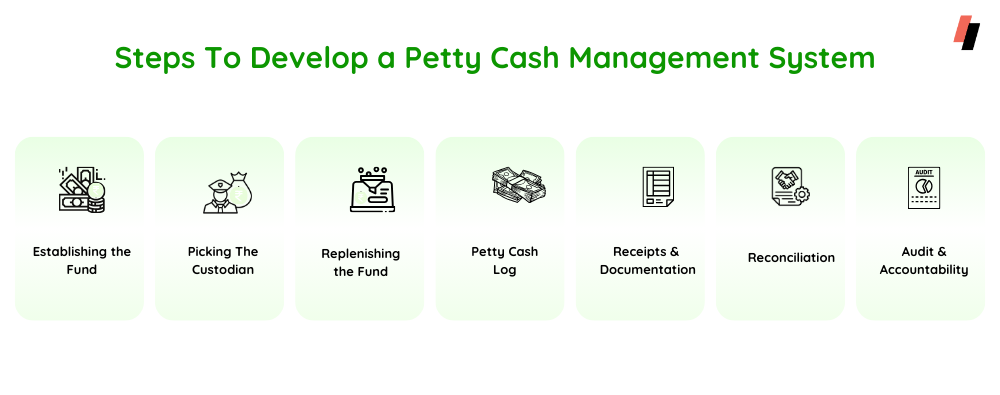

The Petty Cash Management System: Steps To Develop

Establishing the Petty Cash Fund: The first step in the petty cash management system is to establish a petty cash fund. This involves determining the small amount of cash on hand that should be kept, based on the needs of the organization.

Picking The Custodian: A responsible individual, often referred to as the custodian of petty cash, is appointed to manage the petty cash fund. This person is responsible for safeguarding the amount of petty cash, approving & documenting disbursements, & maintaining records.

Replenishing the Fund: As it is used for various expenses, the custodian must ensure that the fund does not run out of money. When the amount of petty cash in the fund reaches a predetermined low point, petty cash needs to be replenished, typically by writing a check or transferring funds from the company's bank account.

Petty Cash Log: To track the disbursements and ensure accountability, a petty cash log or ledger is maintained. This log records each withdrawal, the purpose of the expenditure, the date, and the amount spent.

Receipts and Documentation: Every expenditure from the petty cash fund should be supported by receipts or invoices. This documentation is essential for tracking and auditing purposes.

Reconciliation: Periodically, the petty cash fund should be reconciled to ensure that the amount of cash in the fund plus the total of documented expenditures matches the initial fund amount. Any discrepancies should be investigated and resolved.

Audit and Accountability: It's important to periodically audit the petty cash fund to verify that it has been used appropriately and that all transactions are properly documented. Audits help maintain accountability & deter misuse of funds.

The Benefits of Petty Cash & Petty Cash Management

Convenient Small Transactions

Petty cash provides a convenient way for businesses to handle small, everyday expenses such as office supplies, minor repairs, or occasional meals. This eliminates the need for constant reimbursement requests or checks for nominal amounts.

Faster Decision-Making

Having petty cash readily available allows employees to make quick decisions & act on small, time-sensitive needs without waiting for formal approvals or payment processing, which can improve efficiency & productivity.

Reduced Administrative Burden

Petty cash helps reduce the administrative workload associated with tracking & processing numerous small transactions. This can lead to cost savings by minimizing the time and effort required for expense management.

Improved Financial Accountability

Petty cash systems can enhance financial accountability and control. By maintaining a petty cash transaction log, businesses can monitor & regulate spending while ensuring that funds are used for legitimate purposes & properly documented.

Typical Challenges of Petty Cash Management

Managing petty cash manually can present several challenges, which is why many organizations have moved to digital or automated solutions. Here are some typical challenges associated with manual petty cash management:

Risk of Theft or Misappropriation

When cash is handled manually, there's a higher risk of theft or misappropriation by employees or others who have access to the cash. It is difficult to track who took money, when, and for what purpose.

Lack of Accountability

Manual systems often lack proper accountability. Without a digital trail, it is challenging to determine who is responsible for the cash, making it easier for misuse to go unnoticed.

Difficulty in Reconciliation

Reconciling the petty cash fund regularly is time-consuming & error-prone when done manually. This can lead to discrepancies & errors in financial records.

Inefficiency

Managing petty cash manually is inefficient, as it requires physical handling of cash, writing receipts, and keeping detailed records. This can be a time-consuming process.

Record Keeping Issues

Keeping accurate records of every transaction, receipt, and disbursement can be challenging with a manual system. Paper records can be lost or damaged, making it difficult to maintain a clear audit trail.

Cash Float Management

Managing the float (the initial amount of money in the petty cash fund) can be complicated. If not properly monitored, it can lead to running out of funds or having excess cash on hand.

Audit & Compliance Challenges

Meeting audit and compliance requirements can be more challenging with manual petty cash systems, as it's harder to demonstrate the accuracy and legitimacy of transactions.

Limited Access Control

Manual petty cash systems may not provide adequate access control, which can result in unauthorized individuals gaining access to the cash.

Lack of Reporting & Analytics

Manual systems often lack reporting & analytical tools, making it difficult to track and analyze spending patterns or identify areas where cost savings could be achieved.

Inconvenience & Inaccuracy

Petty cash transactions are typically small, and manual handling can lead to inaccuracies and discrepancies. Additionally, employees may find it inconvenient to deal with cash for minor expenses.

What is Petty Cash in the Digital Era: Leveraging Technology to Make Petty Cash Management Easier

Petty cash management has long been a headache for businesses of all sizes. This small but necessary fund is essential for covering petty cash expenses that can't be paid by check or credit card. Traditional systems involve physical cash, receipts, & manual record-keeping, which can be cumbersome, time-consuming & prone to errors. However, in today's tech-savvy world, there are numerous innovative solutions that can streamline & simplify your management.

Digital Petty Cash Management Apps

Digital petty cash management apps have gained popularity in recent years, offering a convenient way to replace the physical cash-based system. These apps allow businesses to set up virtual petty cash accounts, allocate petty cash funds & record their petty cash expenses. Some of the key advantages of these apps include:

Accessibility: Petty cash can be accessed, allocated & managed from anywhere with an internet connection.

Simplified expense tracking: These apps provide features for easily categorizing expenses, attaching receipts& generating reports.

Improved accountability: Digital records leave a clear audit trail, reducing the chances of fraud or mismanagement.

Prepaid Debit Cards

Prepaid debit cards offer another tech-driven solution for petty cash management. These cards can be loaded with a fixed amount of money, and employees can use them to make purchases just like a regular debit or credit card. Benefits of using prepaid debit cards for petty cash include:

Security: Prepaid cards have the option to be locked or monitored remotely, reducing the risk of loss or misuse.

Electronic tracking: Transactions made with prepaid cards can be easily tracked, & statements can be downloaded for accounting purposes.

Reduced reliance on cash: Eliminating physical cash reduces the risk of theft & simplifies accounting.

Expense Management Software

Expense management software can streamline petty cash management by allowing businesses to digitize receipts, track expenses, and automate approval workflows. Many of these solutions integrate with accounting software, making reconciliation and reporting more efficient. Key advantages of expense management software include:

Paperless receipts: Eliminate the need for physical receipts by digitizing and storing them electronically.

Automated approval workflows: Set up rules and notifications for expense approvals, reducing delays and errors.

Real-time reporting: Get real-time insights into petty cash expenditures, helping with budgeting and decision-making.

Mobile Payment Apps

Mobile payment apps like PayPal, Venmo, and Cash App can also be used for petty cash management. These apps allow employees to make small purchases and easily transfer petty cash funds within a few clicks. Benefits of using mobile payment apps include:

Convenience: Employees can quickly reimburse each other for small expenses without needing physical cash.

Digital receipts: Transactions are recorded electronically, making it easier to track and report petty cash expenditures.

Wide acceptance: Many vendors and service providers now accept payments via mobile apps, making it a versatile solution.

How Does Petty Cash Management Software Work?

A petty cash management software works to organize the petty cash account, cash on hand, petty cash funds, the duties of a petty cash custodian to ensure that there is existing clarity and accountability. A petty cash management software includes a lot of things like the following:

Expense Tracking: With digital tools, employees can record expenses, submit receipts, and request reimbursements online. This streamlines the expense reporting process and reduces the chances of errors.

Transparency: These tools offer real-time visibility into petty cash transactions. Managers and finance teams can monitor who spends money, when, and for what purpose.

Audit Trail: A robust audit trail is created for every transaction, making it easier to review past expenses and ensure compliance.

Accessibility: Digital petty cash systems are often accessible via mobile apps or web platforms, making it easy for employees to submit expenses from anywhere, at any time.

Integration: Many digital petty cash tools can integrate with accounting software, making it simpler to reconcile expenses with the organization's overall financial records.

Security: Virtual petty cash funds are generally more secure than physical cash, reducing the risk of theft or mismanagement.

Efficiency: The automation of petty cash management systems leads to increased efficiency, saving time and reducing administrative overhead.

The Petty Cash Management Digital Revolution

To implement a digital system in your organization, follow these steps:

Choose the Right Tool: Research and select a digital tool that best fits your organization's needs and budget.

Training: Train your employees on how to use the selected tool, including expense submission and reimbursement processes.

Policy Development: Update your organization's policy to reflect the new digital system. This policy should outline spending limits, approval processes and reporting requirements.

Integration: If needed, integrate the digital tool with your existing accounting software for seamless financial reconciliation.

Monitoring & Review: Continuously monitor the system's performance, gather feedback and make necessary improvements to enhance efficiency.

Benefits of Digital Petty Cash Management Tools

Increased Efficiency

One of the most significant advantages of using digital tools is easiness and the boost in efficiency. Traditional methods of managing petty cash involve manual record-keeping, counting physical cash, and reconciling expenses. With digital tools, these processes are automated, reducing the time and effort required to manage petty cash. This results in less administrative overhead.

Enhanced Accuracy

Human error is an inherent risk when managing physical cash. Miscounting money or recording expenses incorrectly can lead to discrepancies in your account. Digital tools help minimize these errors. Many tools offer real-time tracking, making it easier to identify and rectify mistakes promptly.

Improved Accountability

Accountability is crucial when managing petty cash. Digital tools provide a transparent and auditable trail of all transactions. Each expense is recorded, time-stamped, and assigned to a specific user or employee.

Streamlined Reporting

Digital petty cash management tools offer the advantage of simplified reporting. You can generate detailed reports, making it easier to analyze expenses, track trends, and prepare financial statements.

Expense Control

One of the challenges of traditional systems is controlling expenses. Employees might be tempted to use petty cash for personal or non-business-related expenses.

Secure Transactions

Digital tools prioritize security. Physical cash is susceptible to theft, loss, or damage. With digital tools, transactions are secure and traceable. You can restrict access to authorized personnel only.