How you can Ensure Cost Savings with an Online Expense Manager

- Spend Management

- 24-Jul-24

What is an Online Expense Manager?

An online expense manager is a software application or tool that helps users track, manage, and analyze their expenses. It allows users to record their expenses, categorize them, set budgets, and generate reports to gain insights into their spending habits. These tools are typically accessible via web browsers or mobile apps, making it convenient for users to manage their finances on the go. Additionally, this app allows you to track, manage, and analyze expenses with ease, enhancing your ability to oversee financial activities efficiently.

Features of an Online Expense Manager

Expense Tracking: One of the primary features of an online expense manager is the ability to track expenses in real-time. Users can manually enter their expenses or link their bank accounts and credit cards to automatically import transactions. This feature is designed to be easy to use, enhancing the user experience by simplifying the process of managing finances.

Budgeting: Online expense managers allow users to set budgets for different categories such as groceries, transportation, and entertainment. Users receive notifications when they exceed their budget, helping them stay on track.

Categorization: Expenses can be categorized into different categories (e.g., food, utilities, rent) for better organization and analysis. Some tools even offer customizable categories to suit individual needs.

Reporting: These tools generate detailed reports and charts that provide insights into spending patterns, trends, and areas where users can cut costs or save money.

Bill Reminders: Online expense managers can also serve as bill reminders, alerting users of upcoming bills and due dates to avoid late payments and associated fees.

Integration: Many online expense managers offer integration with other financial tools and services, such as accounting software, tax preparation services, and mobile payment platforms, to streamline financial management. For Android users, the app is available on Google Play, ensuring easy access and download.

Security: Since these tools deal with sensitive financial information, they prioritize security. They use encryption and other security measures to protect users’ data from unauthorized access.

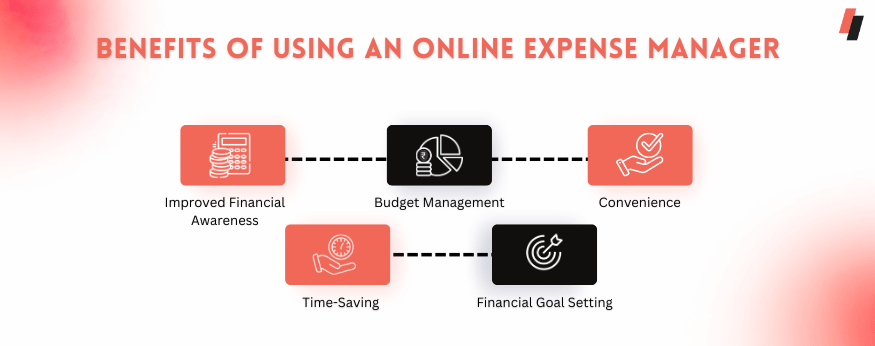

Benefits of Using an Online Expense Manager

Improved Financial Awareness

By tracking expenses and analyzing spending habits, users gain a better understanding of where their money is going and can make informed decisions to improve their financial health.

Budget Management

Online expense managers help users set and stick to budgets, preventing overspending and enabling them to save money for future goals.

Convenience

These tools can be accessed anytime, anywhere, providing users with a convenient way to manage their finances on the go.

Time-Saving

Automating expense tracking and categorization saves users time compared to manual methods, allowing them to focus on other important tasks.

Financial Goal Setting

With insights gained from expense tracking, users can set realistic financial goals and track their progress towards achieving them.

Why do you need an Online Expense Manager?

An online expense manager can be incredibly beneficial for individuals and businesses for several reasons, it allows you to manage business spending efficiently and effectively.

Track Spending: An expense manager helps you keep track of your spending in real-time, providing a clear picture of where your money is going. This visibility is crucial for budgeting and making informed financial decisions.

Budgeting: By categorizing expenses and setting budget limits for each category, you can better manage your finances and avoid overspending. The tool can alert you when you’re approaching or exceeding your budget, helping you stay on track.

Financial Awareness: Seeing your spending habits laid out in front of you can increase your financial awareness. You’ll be more mindful of unnecessary expenses and can make adjustments to save money or allocate funds to more important areas.

Identify Saving Opportunities: An expense manager can help you identify areas where you can cut costs or save money. By analyzing your spending patterns, you may discover subscriptions or services you no longer need.

Avoid Late Payments: Some expense managers offer bill reminders and notifications for upcoming payments, helping you avoid late fees and penalties.

Tax Preparation: Categorizing expenses throughout the year can make tax preparation much easier. You’ll have all your expenses organized and categorized, ready to be reported for tax purposes.

Financial Goal Setting: With a clear understanding of your spending habits and financial situation, you can set realistic financial goals and track your progress towards them.

Accessibility: Online expense managers are usually accessible from anywhere with an internet connection, allowing you to manage your finances on the go.

Security: Most online expense managers offer secure encryption and data protection measures to keep your financial information safe.

Utilizing an online expense manager can take your finances to the next level by offering a comprehensive view and control over your spending, enabling you to make informed decisions to improve your financial management.

Finding the Match of your True Needs

With a plethora of online expense managers available, both free and paid, it's crucial to choose one that aligns with your needs. Consider factors like:

Features: Do you need basic tracking or advanced budgeting tools?

Security: Ensure the platform uses robust security measures to protect your sensitive financial data.

Ease of Use: Opt for an interface that is user-friendly and intuitive.

Mobile Compatibility: Track your finances on the go with a mobile app.

6 Tips to Manage Your Expenses Better

Create a Budget

Start by creating a budget that outlines your income and all necessary expenses, such as rent, utilities, groceries, and transportation. Allocate a portion of your income for savings and discretionary spending. Review and adjust your budget regularly to ensure it aligns with your financial goals.

Track Your Spending

Keep track of all your expenses, including small purchases. Use an online expense manager or a budgeting app to categorize your expenses and identify areas where you can cut back. This awareness can help you make more informed spending decisions.

Prioritize Essential Expenses

Make sure to prioritize essential expenses, such as housing, utilities, and groceries, before allocating money for discretionary spending. This ensures that you cover your basic needs before indulging in the non-essential purchases.

Reduce Unnecessary Expenses

Identify and cut out unnecessary expenses. This could include subscriptions you no longer use, dining out frequently, or impulse purchases. Redirect the money saved towards your savings or paying off debt.

Use Cash or Debit Cards

Consider using cash or debit cards instead of credit cards for your day-to-day expenses. This can help you avoid accumulating high-interest debt and stay within your budget.

Plan for Unexpected Expenses

Set aside a portion of your income for unexpected expenses or emergencies. Having an emergency fund can help you avoid relying on credit cards or loans when unexpected costs arise.

How to find the Perfect Online Expense Manager App?

1. Assess Your Needs:

Financial Tracking Style: Do you crave a detailed breakdown of every penny or a simpler overview of spending categories?

Budgeting Habits: Are you a spreadsheet whiz or do you need an app with built-in budgeting tools and reminders?

Tech Savvy: How comfortable are you with navigating apps?

2. Explore the Feature Landscape:

Expense Tracking: Look for options that allow easy transaction entry, receipt capture, and automatic bank account syncing (if desired).

Budgeting Tools: Consider features like setting spending limits, category allocation, and progress tracking.

Reporting and Insights: Does the app offer insightful reports and visualizations to help you understand your spending patterns?

Goal Setting: Does it allow you to set financial goals and track progress towards them?

3. Prioritize Security:

Data Encryption: Ensure the app uses robust encryption methods to protect your sensitive financial data.

Multi-Factor Authentication: Opt for an app that offers multi-factor authentication for an extra layer of security.

4. Embrace Free Trials and Reviews:

Many expense manager apps offer free trials. Take advantage of these to test-drive features and see if the interface feels user-friendly. Additionally, reading user reviews can provide valuable insights into the app's functionality and potential drawbacks.

5. Consider Additional Factors:

Cost: Free vs paid options? Evaluate features offered by each tier and choose the one that aligns with your needs and budget.

Mobile Compatibility: Does the app have a user-friendly mobile app for on-the-go tracking?

Platform Integration: Does it integrate with other financial tools you use, like your bank or accounting software?

Do you need an Online Expense Manager for your Business?

Absolutely, online expense managers offer significant benefits for businesses of all sizes. Here's why you might consider using one:

Streamlined Expense Tracking

Manual expense tracking is a recipe for lost receipts, wasted time, and frustration. Expense managers allow employees to easily submit receipts and categorize expenses electronically. This creates a centralized system for tracking all business spending.

Simplified Expense Reporting

No more chasing down paper trails! Employees can submit expense reports electronically, complete with attached receipts. Managers can then review and approve reports efficiently, saving everyone valuable time.

Enhanced Visibility and Control

Expense managers provide real-time insights into company spending. You can easily see where your money goes, identify areas for cost savings, and make better financial decisions.

Improved Compliance

Some expense managers integrate with accounting software, ensuring proper categorization of expenses for tax purposes. They can also help enforce company spending policies by flagging any non-compliant transactions.

Increased Efficiency

By automating expense tracking and reporting, online expense managers free up valuable time for both employees and accounting teams. This allows them to focus on more strategic tasks.

Scalability

Expense managers can grow with your business. They can accommodate multiple users, currencies, and complex spending categories.

Here are some additional factors to consider

Company Size: Large companies with high volumes of expenses may benefit more from feature-rich expense management software. Smaller businesses might find success with simpler, free options.

Employee Spending Habits: If your employees frequently travel or incur a lot of out-of-pocket expenses, an expense manager can significantly streamline the reimbursement process.

Ultimately, an online expense manager can be a valuable tool for any business that wants to gain control over spending, improve efficiency, and make smarter financial decisions.