Imprest Cash: Understanding the Imprest System & Petty Cash

- Finance

- Spend Management

- 14-May-24

In any organization, managing small, routine expenses efficiently is crucial. This is where the Imprest cash system comes in. Designed to streamline the petty cash management, the Imprest system offers several advantages over traditional methods. Let's delve into what the Imprest cash system entails, why it's beneficial, how it works, and its key differences from standard petty cash management.

What Is an Imprest Cash System?

The Imprest cash system is a method used by businesses to manage small, routine expenses. It involves maintaining a fixed amount of money, known as the Imprest fund, to cover these expenses. The petty cash fund is replenished periodically to maintain the fixed amount, ensuring that there is always enough cash available for day-to-day needs.

Why Use an Imprest Account for Petty Cash?

Using an Imprest account for petty cash offers several advantages. It helps in better control and accountability of funds, reduces the risk of theft or misuse, simplifies accounting and record-keeping, and ensures that there is always enough cash on hand to cover small expenses.

How Does The Imprest Cash Procedure Work?

The Imprest cash procedure works by establishing a fixed amount of cash, known as the Imprest fund, which is used to cover small, routine expenses. When the fund runs low, it is replenished to maintain the fixed amount. All transactions involving the Imprest fund are recorded and accounted for, ensuring transparency and accountability.

What Is the Purpose of an Imprest Account?

The primary purpose of an Imprest account is to provide a convenient and efficient way to manage small, routine expenses. By maintaining a fixed balance, the Imprest account helps in better control and accountability of funds, simplifies accounting and record-keeping, and ensures that there is always enough cash on hand to cover day-to-day needs.

Steps in the Imprest System

Establish the Imprest fund: Determine the fixed amount of cash needed for petty expenses.

Replenish the fund: When the fund runs low, replenish it to maintain the fixed amount.

Record transactions: Record all transactions involving the Imprest fund to ensure transparency and accountability.

Audit the fund: Periodically audit the Imprest fund to ensure that it is being used appropriately and that all transactions are properly recorded.

What Are The Drawbacks of the Imprest System?

While the Imprest system offers several advantages, it also has some drawbacks. One of the main drawbacks is the need for regular monitoring and auditing to ensure that the fund is being used appropriately. Additionally, the amount of cash may not always be sufficient to cover all expenses, leading to the need for additional funds.

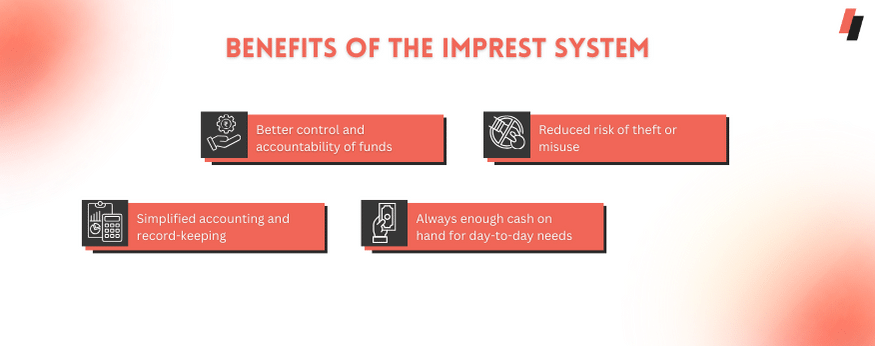

Benefits of the Imprest System

Better control and accountability of funds

Reduced risk of theft or misuse

Simplified accounting and record-keeping

Always enough cash on hand for day-to-day needs

Challenges of the Imprest System

While the Imprest system offers several benefits, it also presents some challenges that organizations need to be aware of. These challenges include:

Monitoring and Replenishment: One of the main challenges of the Imprest system is the need for regular monitoring and replenishment of the Imprest fund. Failure to replenish the fund in a timely manner can lead to cash shortages and disrupt day-to-day operations.

Accountability and Oversight: Ensuring accountability and oversight in the Imprest system can be challenging, especially in larger organizations with multiple departments or locations. It is important to have robust controls in place to prevent misuse or mishandling of funds.

Cash Handling Risks: Handling cash comes with inherent risks, such as theft or loss. Organizations using the Imprest system need to implement strict security measures to mitigate these risks, such as secure storage and regular audits.

Record-Keeping and Documentation: Proper record-keeping and documentation are essential for the Imprest system to function effectively. Keeping track of all transactions and ensuring that they are properly recorded can be challenging, especially in high-volume environments.

Limited Flexibility: The fixed nature of the Imprest fund can be a limitation, especially if expenses vary significantly from period to period. Organizations may find it challenging to adjust the fund size to accommodate changing needs.

What Is The Difference Between Petty and Imprest Cash?

Petty cash is a term used to describe a small amount of cash kept on hand to cover minor expenses, while the Imprest cash system is a specific method for managing petty cash. The key difference between the two is that the Imprest system involves maintaining a fixed amount of cash, which is replenished periodically, while petty cash management may involve less structured methods.