The Best Prepaid Card for Business: Essential Guide for Entrepreneurs

- Corporate Cards

- 20-Mar-25

Ensuring that company funds are used appropriately, avoiding overspending, and providing employees with an efficient way to make necessary business-related purchases are all key aspects of sound financial management.

As businesses grow, maintaining oversight of spending can become increasingly complex, particularly when multiple employees need to make purchases on behalf of the company. One solution that has gained significant traction in recent years is the use of prepaid cards for business.

Prepaid cards provide a controlled, secure, and efficient way to handle company expenses while giving employees the flexibility to make purchases when necessary. By offering real-time tracking, spending restrictions, and easy reload options, prepaid cards have become an indispensable tool for businesses seeking to streamline their financial operations.

In this blog, we will explore the key features and benefits of business prepaid cards, how they work, their advantages over other payment methods, and how businesses can select the best prepaid card for their needs. In this guide, we will also explore some of the best business prepaid cards available, categorized based on their specific advantages and features.

What is a Prepaid Card?

A prepaid card is a payment card that requires the user to load funds onto it before it can be used. Unlike a debit or credit card, a prepaid card is not linked to a bank account, nor does it provide access to a line of credit. Instead, it is preloaded with a specific amount of money, and transactions made with the card deduct from the preloaded balance. Once the balance is exhausted, the card cannot be used unless additional funds are loaded onto it.

Unlike a business debit card, which draws funds directly from a linked bank account, a prepaid card requires funds to be preloaded, offering more control over spending.

Prepaid cards come in two forms: physical cards and virtual cards. Physical prepaid cards look similar to traditional debit or credit cards and can be used for in-store purchases, ATM withdrawals, and online transactions. Virtual cards, on the other hand, are digital-only cards that can be used for online purchases or other electronic payments but do not have a physical form.

For businesses, prepaid cards can be an effective tool to manage employee spending, control business expenses, and simplify accounting processes. These cards offer flexibility, ease of use, and enhanced security compared to other traditional payment methods, such as credit or debit cards.

Benefits of Business Prepaid Cards

Business prepaid cards offer a wide range of benefits for businesses of all sizes. Below are some of the key advantages of using prepaid cards for managing business expenses:

1. Provide Employees with Access to Company Funds with Smart Spending Restrictions

Business owners can issue prepaid cards to employees, providing them with a convenient way to make business purchases while setting a spending limit to control expenses. Employers can determine the amount of money available on the card, ensuring that employees do not overspend. Additionally, companies can set merchant category restrictions to prevent purchases from unauthorized vendors or non-business-related purchases. This level of control helps businesses maintain financial discipline and avoid misuse of funds.

2. Track Money in Real-Time and Reconcile Accounts in Seconds

One of the most significant advantages of using prepaid cards is the ability to track expenses in real-time. With real-time visibility, business owners or finance teams can instantly monitor employee spending and ensure that all transactions align with the company’s budget. Prepaid cards typically come with integrated expense management tools that allow businesses to generate real-time reports and track spending patterns. This feature makes it easier to reconcile accounts quickly and accurately, ensuring that financial records are up-to-date.

3. Employees Don’t Have to Worry About Making Business Purchases

Prepaid cards provide a simple solution for employees to make business purchases without the need to carry cash or use personal funds. Employees can use the prepaid card to pay for office supplies, travel expenses, or miscellaneous purchases, ensuring that the business is paying for expenses directly rather than relying on personal reimbursement processes. This reduces administrative burdens and helps employees stay focused on their work without worrying about out-of-pocket expenses. Additionally, some prepaid cards allow employees to withdraw cash from ATMs, providing further flexibility for business-related expenses.

4. Simplify Expense Management and Empower Employees with a Convenient Spending Tool

Prepaid cards offer businesses a convenient solution for managing everyday expenses. Instead of dealing with petty cash or complex reimbursement processes, businesses can issue prepaid cards to employees for specific purposes. This simplifies expense management by reducing paperwork and the need for manual approvals. It also gives employees the freedom to make purchases as needed, while still maintaining financial oversight through the prepaid card's spending limits and real-time tracking features.

5. Improve Cash Flow by Pre-Funding Expenses and Avoiding the Debt Cycle

By using prepaid cards, businesses can avoid the pitfalls of traditional credit card debt. Instead of relying on credit cards and getting trapped in a cycle of interest payments and revolving debt, prepaid cards require pre-funding before use. This approach allows businesses to manage their cash flow more effectively, ensuring that expenses are covered upfront without accumulating debt.

How Prepaid Cards Work

Prepaid cards work by loading a specific amount of money onto the card before it can be used for purchases. Here’s a breakdown of how prepaid business cards typically work:

Loading Funds:

Business owners or authorized personnel load funds onto the prepaid card. This can be done via bank transfers, credit card payments, or depositing money directly onto the card. Funds can be loaded onto the prepaid card via bank transfers, allowing seamless integration with existing bank accounts for efficient financial management. Many prepaid card providers also offer automatic reloading options, which ensure the card remains funded as needed.

Making Purchases:

Once the prepaid card is loaded with funds, employees can use the card to make purchases. Whether it is for office supplies, travel expenses, or online purchases, the card will deduct the cost of the transaction from the preloaded balance.

Tracking Expenses:

Prepaid cards typically come with expense tracking tools that provide real-time visibility of card usage. Business owners can monitor each transaction as it happens and ensure that spending is within budget.

Reloading the Card:

If the prepaid card balance runs low, it can be reloaded with additional funds. Depending on the provider, businesses may have the option for automatic reloading to ensure the card is always available for employee purchases.

Cash Withdrawals:

In some cases, prepaid cards can be used to make cash withdrawals at ATMs. However, businesses should be mindful of withdrawal limits and ATM fees, which may vary depending on the provider.

Online and In-Store Use:

Prepaid cards can be used for online purchases and in physical stores that accept card payments. This makes them a versatile tool for businesses with both digital and in-person spending needs.

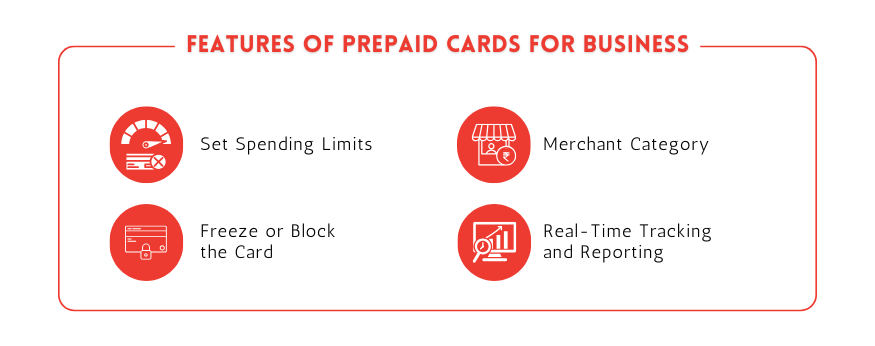

Features of Prepaid Cards for Business

Prepaid cards come with several features designed to make them a valuable tool for businesses. These features include:

Set Spending Limits:

Business owners can set spending limits for individual cards to control how much employees can spend. This feature ensures that employees cannot exceed their allotted budget, helping to maintain tight control over company finances.

Merchant Category Restrictions:

To prevent unauthorized purchases, prepaid cards can be restricted to specific merchant categories. For example, businesses can limit spending to office supplies, travel expenses, or miscellaneous purchases, thereby preventing employees from using the cards for personal expenses.

Freeze or Block the Card:

If a prepaid card is lost or stolen, it can be frozen or blocked immediately to prevent unauthorized use. This enhances security and reduces the risk of fraud.

Real-Time Tracking and Reporting:

Prepaid card providers often offer tools for real-time tracking of card usage. Business owners can view transactions, generate reports, and monitor spending on the go, making it easier to manage finances.

Corporate prepaid cards are particularly beneficial for larger organizations, offering enhanced control over business expenses and reducing the risk of fraud.

Advantages of Prepaid Cards Over Other Payment Methods

When compared to other payment methods like traditional credit cards or debit cards, prepaid cards offer several advantages for businesses:

No Credit Check:

Unlike credit cards, which often require a credit check, prepaid cards do not rely on the creditworthiness of the business. This makes them an ideal option for businesses with limited or poor credit histories.

Controlled Spending:

Prepaid cards offer businesses complete control over employee spending. With features like spending limits and merchant restrictions, business owners can ensure that funds are used appropriately without the risk of overspending.

No Interest Charges or Hidden Fees:

Prepaid cards typically do not charge interest or carry the hidden fees often associated with credit cards. This makes them a cost-effective payment option for businesses.

Enhanced Security Features:

Prepaid cards come with enhanced security features like the ability to freeze or block the card in case of loss or theft. This adds a layer of protection against fraud.

Simplified Petty Cash Management:

For businesses that deal with petty cash, prepaid cards provide a more streamlined solution. Instead of managing physical cash, businesses can load funds onto prepaid cards and track spending in real-time, ensuring accountability.

Who Can Benefit from Prepaid Cards?

Prepaid cards are a versatile financial tool that can benefit a wide range of individuals and businesses. For small business owners, prepaid cards offer an efficient way to manage employee expenses and track spending without the need for a traditional bank account.

Freelancers and independent contractors can use prepaid cards to separate personal and business expenses, simplifying their financial management.

Large corporations can streamline their expense management processes and reduce administrative burdens by issuing prepaid cards to employees. This allows for better control over business expenses and real-time tracking of spending. Non-profit organizations can also benefit from prepaid cards by efficiently managing donations and expenses, ensuring that funds are used appropriately.

Prepaid cards are particularly useful for businesses that have multiple employees who need to make purchases on behalf of the company. They provide a convenient way to manage petty cash expenses and set spending limits, ensuring that funds are used strictly for business purposes.

Additionally, businesses that need to make international transactions can benefit from the flexibility and security of prepaid cards. By reducing the risk of overspending and improving financial control, prepaid cards help businesses maintain financial discipline and transparency.

Choosing the Best Prepaid Card for Your Business

When selecting a prepaid business card, it’s essential to consider a few factors to ensure it meets your company’s needs.

When selecting the best prepaid card for your business, it’s essential to consider a few factors:

Fees: Compare the fee structure of different prepaid card providers. Look for cards with low or transparent fees, including monthly maintenance fees, ATM withdrawal fees, and reloading fees.

Flexibility and Customization: Choose a card provider that offers flexible spending limits, customizable controls, and the ability to adjust settings as needed. This ensures the card meets your business’s specific needs.

Acceptance and Integration: Ensure that the prepaid card is widely accepted at merchant outlets and compatible with your accounting systems for seamless expense tracking.

Customer Support: Opt for a provider with reliable customer support to help resolve issues and answer any questions related to card usage or fees.

When selecting a prepaid card for your business, consider factors such as fees, spending limits, expense tracking capabilities, security features, and customer support. Look for cards with low or no monthly fees and no hidden fees. Ensure the card allows you to set customizable spending limits and offers robust security features like two-factor authentication and encryption. Additionally, choose a card issuer that provides excellent customer support to assist with any issues or questions.

Prepaid Card Security

Security is a top priority when using prepaid cards for business expenses. Prepaid cards come with a range of security features designed to protect your business and employees. Two-factor authentication requires a second form of verification, such as a code sent to your phone, to access your account, adding an extra layer of security. Advanced encryption technology protects your data, ensuring that sensitive information remains secure.

If a prepaid card is lost or stolen, you can temporarily freeze the card to prevent unauthorized use. Setting spending limits on prepaid cards helps prevent overspending and ensures that funds are used strictly for business purposes. Real-time alerts notify you of any suspicious activity or transactions, allowing you to take immediate action if necessary. Additionally, zero-liability protection safeguards you from unauthorized transactions, providing peace of mind.

To maximize the security of your prepaid cards, follow best practices such as keeping your card and account information confidential, monitoring your account activity regularly, and reporting lost or stolen cards immediately. Use strong passwords and enable two-factor authentication to protect your account. Keep your card software and apps up to date to benefit from the latest security enhancements.

By choosing a secure prepaid card and adhering to these best practices, you can enjoy the benefits of prepaid cards while minimizing the risks.

Integration with Accounting Systems

Integrating prepaid cards with popular accounting software is a game-changer for businesses seeking efficient financial management. This integration automates expense tracking and reconciliation, reducing manual effort and the risk of errors.

By syncing transactions with accounting systems, businesses can generate accurate financial reports, track expenses in real-time, and gain better visibility into their cash flow. This seamless process allows for faster decision-making, improved budgeting, and enhanced financial control. Ultimately, it streamlines financial operations, helping businesses stay on top of their spending while maintaining transparency and accountability in their financial records.

Best Practices for Using Prepaid Cards

Choose the Right Prepaid Card

Selecting a prepaid card that aligns with your business needs is crucial. Ensure it offers features like integration with accounting software, low fees, and the ability to track expenses in real time.

Integrate with Accounting Systems

Integrating prepaid cards with popular accounting software allows businesses to automate expense tracking and reconciliation. This minimizes manual data entry, reduces errors, and enhances financial visibility, making it easier to manage cash flow and budgets.

Set Spending Limits

Implement spending limits on prepaid cards to control and monitor expenses. This helps prevent overspending and ensures that funds are used strictly for business purposes.

Track Expenses in Real-Time

Leverage prepaid card software that allows for real-time tracking of transactions. This ensures you have up-to-date insights into your business’s spending, helping to identify potential cost savings and avoid financial surprises.

Use Prepaid Cards for Specific Expenses

To ensure better tracking and control, use prepaid cards for designated business expenses, such as travel, office supplies, or client meetings. This segregation of funds makes it easier to categorize expenses and prepare financial reports.

Monitor and Reconcile Regularly

Stay on top of your prepaid card usage by regularly monitoring transactions and reconciling them with your accounting software. Automating this process ensures accuracy and helps in identifying discrepancies early on, leading to better financial management.

Conclusion

In conclusion, prepaid cards provide businesses with a convenient, cost-effective solution for managing payments and expenses. They offer controlled spending limits, enhanced security features, and simplified expense management, making them a practical choice for businesses of all sizes.

By selecting the right prepaid card and adhering to best practices, businesses can ensure greater financial control, improve transparency, and streamline their financial processes.

This, in turn, helps businesses optimize cash flow, minimize overspending, and ultimately boost their bottom line, creating a more efficient and secure payment system for both everyday operations and strategic growth.