What Are Accounting Policies and How Are They Used?

- Best Practices

- Finance

- 12-May-24

Accounting policies are the principles, rules, and procedures that guide an organization's financial accounting practices. These policies ensure that financial statements are prepared consistently, accurately, and in compliance with relevant accounting standards. They are essential for providing transparency, comparability, and reliability in accounting and financial reporting.

Why Are Accounting Policies Important?

The importance of accounting policies can not be understated, here's why

Consistency: Accounting policies help maintain consistency in financial reporting and on financial statements. They ensure that similar transactions are treated the same way across different accounting periods, allowing for meaningful comparisons.

Compliance: Policies ensure that financial statements adhere to relevant accounting standards, regulations, and laws, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Transparency: By disclosing accounting policies, organizations provide stakeholders with insights into how financial transactions are recorded, measured, and reported, enhancing transparency and trust.

Decision-making: Clear accounting policies assist management in making informed decisions based on accurate and reliable financial information.

Auditing: Policies provide a framework for external auditors to assess the organization's financial statements for accuracy and compliance.

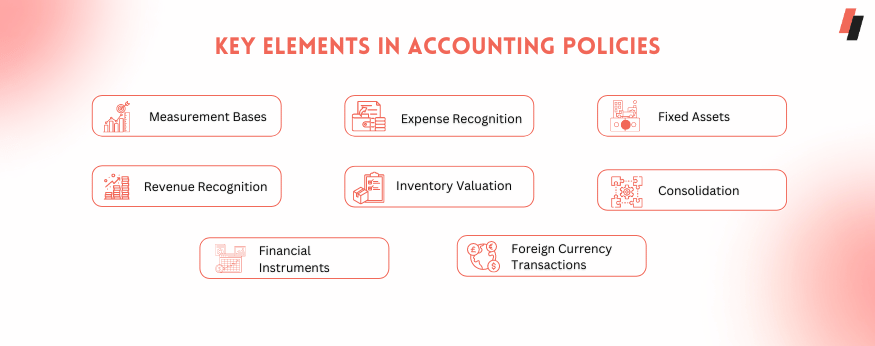

Key Elements in Accounting Policies

Measurement Bases: Specify the methods used to measure assets, liabilities, income, and expenses. Common measurement bases include historical cost, fair value, and net realizable value.

Revenue Recognition: Describe the criteria for recognizing revenue, such as cost of goods sold, and the amount can be reliably measured.

Expense Recognition: Outline when and how expenses are recognized, including recognition of depreciation, amortization, and provisions.

Inventory Valuation: Detail the method used to value inventory, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out).

Fixed Assets: Provide guidelines for recognizing, valuing, and depreciating fixed assets over their useful lives.

Financial Instruments: Specify how financial instruments, such as derivatives and investments, are measured and accounted for.

Consolidation: Describe the criteria for consolidating financial statements of subsidiaries and other entities.

Foreign Currency Transactions: Explain how foreign currency transactions are recorded, including the treatment of gains and losses from currency fluctuations.

Impact on Financial Reporting & Financial Statements

Comparability

Consistent accounting policies enable stakeholders to compare financial statements across different periods and entities.

Reliability

Policies ensure that financial information is reliable, reducing the risk of errors and misstatements.

Disclosure

Transparent disclosure of accounting policies provides stakeholders with a better understanding of the organization's financial position and performance.

Auditability

Clear policies make financial statements easier to audit, ensuring compliance with auditing standards and regulatory requirements.

What is an accounting policy comprised of?

An accounting policy is comprised of several key components that outline the principles, rules, and procedures governing an organization's financial accounting practices. These components help ensure consistency, transparency, and compliance with relevant accounting standards. The main elements of an accounting policy include:

Purpose and Scope

This section defines the purpose of the accounting policy and specifies the areas or transactions to which it applies. It clarifies the policy's scope and ensures that it is applied consistently across the organization.

Measurement Bases

Accounting policies specify the methods used to measure and value assets, liabilities, income, and expenses. Common measurement bases include historical cost, fair value, and net realizable value.

Revenue Recognition

Policies outline the criteria for recognizing revenue, including when goods or services are delivered, and the amount can be reliably measured. This ensures that revenue is recognized in the appropriate accounting period.

Expense Recognition

Policies describe when and how expenses are recognized, including the recognition of depreciation, amortization, and provisions. This helps in matching expenses with the revenue they generate.

Inventory Valuation

Policies detail the method used to value inventory, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out). This ensures that inventory is valued consistently and accurately.

Fixed Assets

Policies provide guidelines for recognizing, valuing, and depreciating fixed assets over their useful lives. This helps in maintaining accurate records of fixed assets and their associated costs.

Financial Instruments

Policies specify how financial instruments, such as derivatives and investments, are measured and accounted for. This ensures that financial instruments are recorded accurately and fairly.

Consolidation

Policies describe the criteria for consolidating financial statements of subsidiaries and other entities. This ensures that the financial statements provide a true and fair view of the organization's financial position and performance.

Foreign Currency Transactions

Policies explain how foreign currency transactions are recorded, including the treatment of gains and losses from currency fluctuations. This ensures that foreign currency transactions are recorded accurately and in accordance with accounting standards.

Disclosure

Accounting policies should include a disclosure section that provides stakeholders with information about the organization's accounting principles and practices. This enhances transparency and helps stakeholders understand the organization's financial statements.

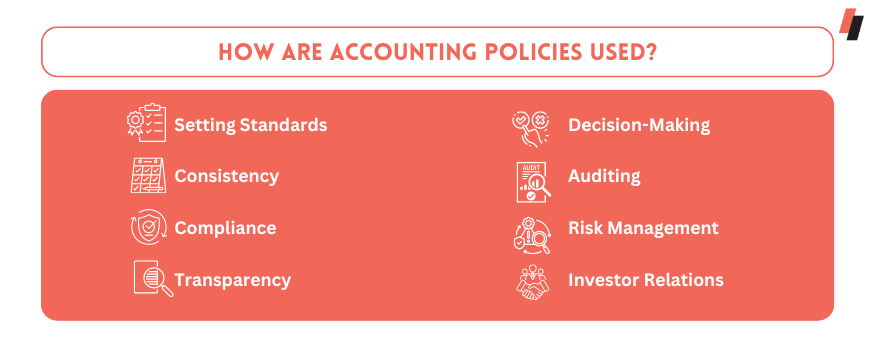

How are accounting policies used?

Accounting policies are used in several ways to guide an organization's financial accounting practices and ensure the accuracy, consistency, and transparency of its financial reporting. Some key uses of accounting policies include:

Setting Standards: Accounting policies establish the standards and guidelines that govern how financial transactions are recorded, measured, and reported. They ensure that these practices are consistent across the organization and comply with relevant accounting standards and regulations.

Consistency: By providing clear guidelines, accounting policies help ensure consistency in financial reporting. They ensure that similar transactions are treated the same way across different accounting periods, enabling stakeholders to make meaningful comparisons.

Compliance: Accounting policies help ensure that financial statements comply with relevant accounting standards, regulations, and laws, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). This helps the organization avoid penalties and maintain its credibility.

Transparency: Accounting policies promote transparency by disclosing how financial transactions are recorded, measured, and reported. This helps stakeholders, such as investors, creditors, and regulators, understand the organization's financial position and financial performance.

Decision-Making: Clear accounting policies assist management in making informed decisions based on accurate and reliable financial information. By providing a framework for financial reporting, accounting policies help management assess the financial implications of different courses of action.

Auditing: Accounting policies provide a framework for external auditors to assess the organization's financial statements for accuracy and compliance with relevant accounting standards. This helps ensure the reliability of the financial statements.

Risk Management: Accounting policies can help mitigate financial risks by providing guidelines for recording and reporting transactions. Example of an accounting scenario, policies related to revenue recognition can help prevent the premature recognition of revenue, reducing the risk of financial misstatements.

Investor Relations: Accounting policies play a role in investor relations by providing stakeholders with insights into how the organization's financial statements are prepared. This can help build trust and confidence among investors, creditors, and other stakeholders.

Conservative vs. Aggressive Policies

Conservative and aggressive accounting policies represent two ends of the spectrum in financial reporting, particularly in terms of how they recognize and report revenues, expenses, assets, and liabilities. Let's delve into the differences between the two:

Conservative Policies:

1. Revenue Recognition: Conservative policies recognize revenue only when it is realized or realizable, and earned, often waiting until cash is received. This approach tends to understate current profits.

2. Expense Recognition: Expenses are recognized as soon as they are reasonably certain, even if there is some uncertainty about the timing or amount. This approach tends to overstate current expenses.

3. Asset Valuation: Assets are valued at the lower end of the cost or market value spectrum, emphasizing prudence and reducing the risk of overvaluing assets.

4. Liability Recognition: Liabilities are recognized sooner rather than later, even if there is uncertainty about the timing or amount, ensuring a conservative approach to financial obligations.

5. Disclosure: Conservative policies often result in more extensive disclosures in financial statements, providing stakeholders with a clearer picture of the organization's financial position.

Aggressive Policies:

1. Revenue Recognition: Aggressive policies recognize revenue as soon as it is earned, even if cash has not been received. This approach tends to overstate current profits.

2. Expense Recognition: Expenses are recognized later rather than sooner, often delaying recognition until there is certainty about the timing or amount. This approach tends to understate current expenses.

3. Asset Valuation: Assets are valued at the higher end of the cost or market value spectrum, potentially leading to an overvaluation of assets.

4. Liability Recognition: Liabilities are recognized later rather than sooner, often delaying recognition until there is certainty about the timing or amount, potentially understating financial obligations.

5. Disclosure: Aggressive policies may result in less extensive disclosures in financial statements, potentially obscuring the organization's true financial position.

What Is the Difference Between Accounting Policies and Principles?

Accounting policies and principles are both important components of financial reporting, but they serve different purposes and have distinct characteristics. Here's a breakdown of the key differences between accounting policies and principles:

Key Differences:

Specificity: Accounting policies are specific rules and guidelines that dictate how transactions are recorded, while accounting principles are broader concepts that guide the overall practice of accounting.

Applicability: Accounting policies are specific to individual organizations, while accounting principles apply universally to all organizations.

Flexibility: Accounting policies can be tailored to suit the needs of the organization, while accounting principles are generally fixed and apply consistently across all organizations.

Regulatory Compliance: Both accounting policies and principles must comply with relevant accounting standards and regulations, but policies are more specific to individual organizations' practices, while principles are foundational concepts that underpin all accounting practices.

Ensure the Implementation of Accounting Policies in your Organisation

Ensuring that policies are followed in an organization requires a combination of clear communication, training, monitoring, and enforcement. Here are some steps to help ensure policies are followed effectively:

Clear Communication: Communicate policies clearly to all employees, including the purpose of the policy, its importance, and the expected behavior or actions. Use multiple channels, such as employee handbooks, email, meetings, and posters, to reinforce the message.

Training: Provide training to employees on the policies relevant to their roles. Ensure that employees understand the policies and know how to apply them in their day-to-day work.

Monitoring: Regularly monitor compliance with policies through audits, surveys, and feedback mechanisms. Identify any areas of non-compliance and take corrective action promptly.

Accountability: Hold employees accountable for following policies. Establish consequences for non-compliance, such as warnings, retraining, or disciplinary action, and apply them consistently.

Leadership Example: Leaders should lead by example and demonstrate their commitment to following policies. When employees see leaders following policies, they are more likely to do the same.

Feedback and Improvement: Encourage employees to provide feedback on policies and processes. Use this feedback to identify areas for improvement and update policies as needed.

Recognition: Recognize and reward employees who consistently follow policies. This can help reinforce the importance of compliance and motivate others to do the same.

Regular Review: Regularly review and update policies to ensure they remain relevant and effective. Solicit input from employees and stakeholders to identify areas for improvement.

Culture of Compliance: Foster a culture of compliance within the organization, where following policies is seen as a core value. Encourage open communication and transparency to help maintain this culture.

Consistency: Apply policies consistently across all levels of the organization. Inconsistencies in policy enforcement can undermine their effectiveness and lead to confusion among employees.

Digital solutions to ensure policy compliance: Introducing Spend Management

Introducing digital solutions for spend management can greatly enhance policy compliance by automating processes, providing real-time insights, and improving overall efficiency. Here are some digital solutions that can help ensure policy compliance in spend management:

Expense Management Software: Implementing an expense management software can streamline the expense reporting process, enforce spending limits, and flag non-compliant expenses. It can also provide detailed reports and analytics for better visibility and control.

Pre-Approval Workflows: Use digital tools to create pre-approval workflows for expenses, ensuring that all expenses are approved before they are incurred. This helps prevent overspending and ensures compliance with spending policies.

Policy Enforcement: Utilize software features that allow you to set and enforce spending policies, such as maximum limits for certain categories of expenses. Automated alerts can notify employees and managers when policies are violated.

Receipt Management: Digital receipt management solutions can help ensure that all expenses are supported by valid receipts. This reduces the risk of fraudulent or non-compliant expenses.

Mobile Apps: Provide employees with mobile apps for submitting expenses on the go. Mobile apps can also include features like receipt capture, mileage tracking, and real-time expense tracking, improving compliance and convenience.

Integration with ERP Systems: Integrate your expense management software with your ERP (Enterprise Resource Planning) system for seamless data exchange and better visibility into overall spend.

By leveraging these digital solutions, organizations can improve compliance with spending policies, reduce manual errors, and gain better control and visibility into their overall spend management processes.